Price Action Forex Trading Strategy

Today’s education will focus on some price action trading rules. The most important thing in any type of trading is to have a solid set of rules and then to have the self-control to follow those rules. Forex traders have a job to look for low-risk and high-reward price levels to shoot at. As we know price action is a basic trading concept of trading forex. With price action, we can identify trends that are beginning and changing. Especially if we used daily charts in our first variable analysis.

Price Action Basics Rules:

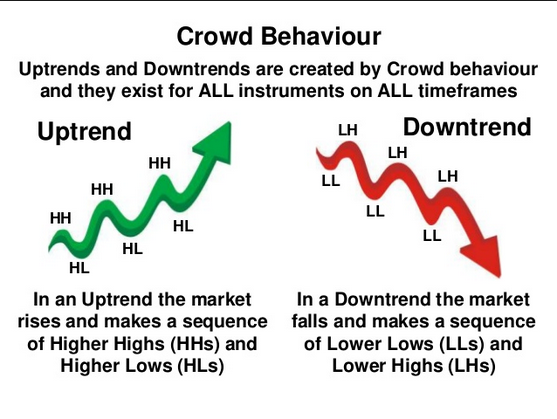

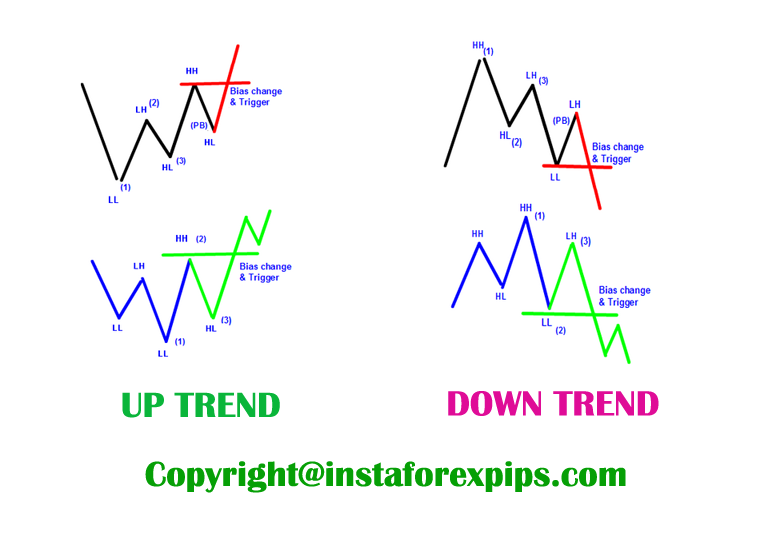

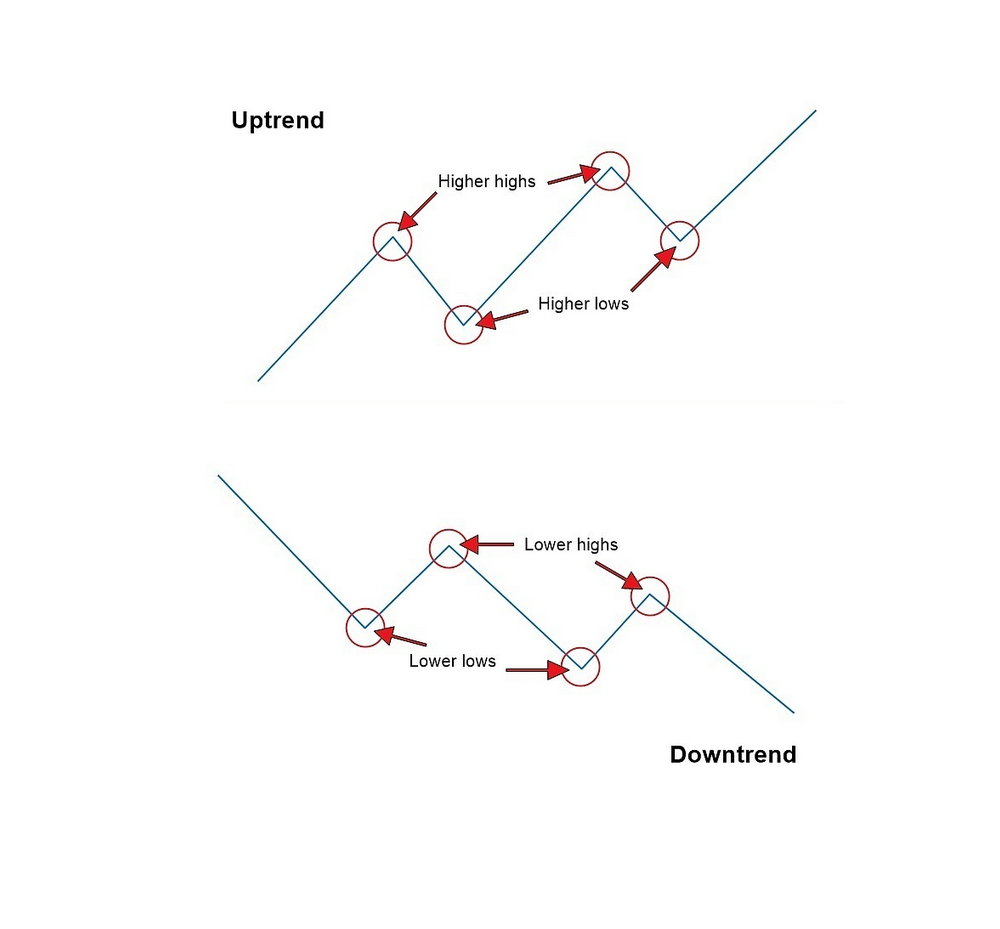

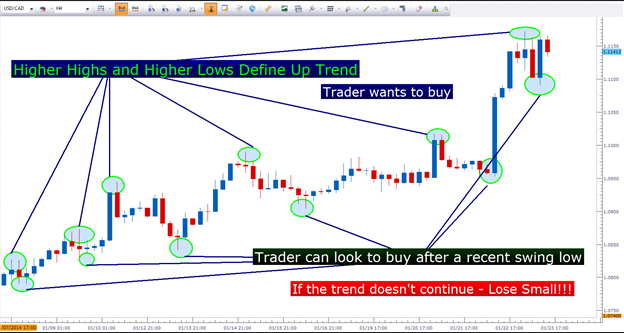

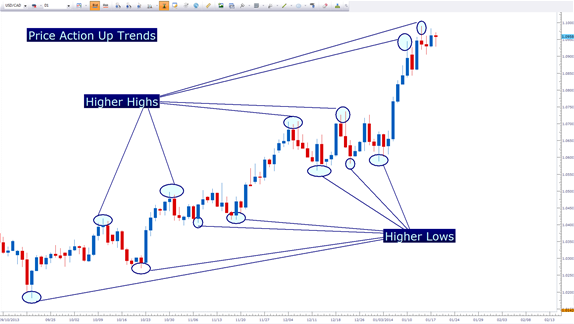

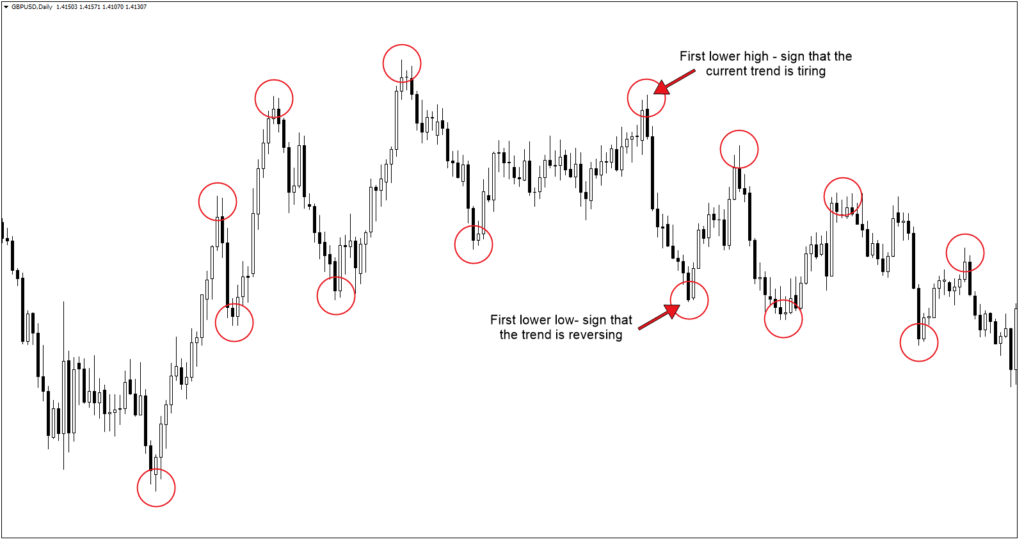

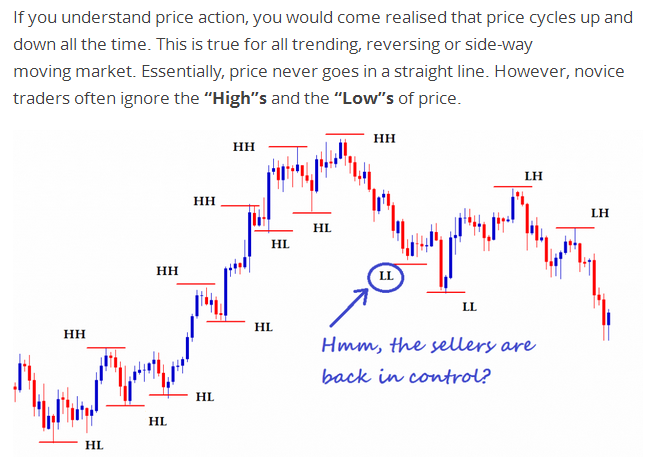

The basic rules of forex price action strategies to determine the market’s trend is just simple. The key is if there’s a first higher low then the price breakout of the previous lower high and making the first higher high so trend up setups just happened and if there’s a first lower high then the price breakout previous higher low and making the first lower low so it means trend down it’s just happened.

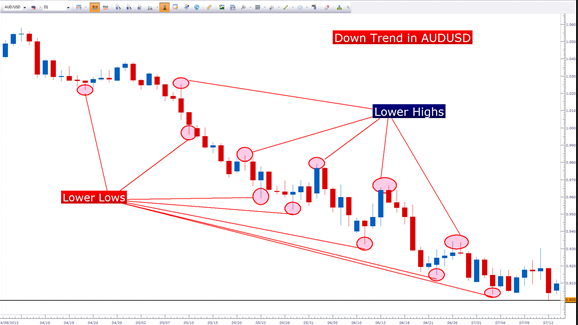

Learn about how we read a current trend-based price action basics tutorial images below :

As seen in some pictures of basic rules of price action trading strategy, we need some filter time frame to get accurate data to read the current major trend that is running or even sideways. Use the daily chart as our main variable of trading recommendation to read the current trend after we know the up trend or down trend that remains, we look for the best signals based on bearish or bullish reversal candlestick patterns confirmation in one hour or four hours even better. Example trading scenario: if the daily is an uptrend, then we look only at bullish reversal candlestick patterns in an hour or four-hour time frame as our entry trading signals which usually those bullish reversal candlestick patterns appear in higher low and if the daily is a downtrend, then we only looking bearish reversal candlestick patterns confirmation in H1 or H4 charts as our short entry trading signals and those of bearish reversal candlestick patterns appear in lower high. Combined with Fibonacci extension levels to measure the strength of the trend.

How To Read Market Structure With Price Action, It Works Every Time !!

With this price action strategy as described above, I think trading forex will be more comfortable as long we are patient to wait for the confirmation of the signal based on the current trend of the daily chart because the best forex trading strategy is trend following. The strength of these trading opportunities is very accurate. So, the main basics of price action strategy are waiting for the price to make a new wave that indicates breaking the previous lower high for the up trend and breaking the previous higher low for the downtrend. And remember always use candlestick basics as our trading confirmation to get accurate trading signals.

Economics indicators from Forex Factory, Market Watch, Trading Economics, Bloomberg, or any other kind of economics news providers only for minor factors of the power trend strength but not as primary parameters in using this price action strategy.

With this price action don’t get affected by any lagging forex indicators anymore. Only by reading forex candlestick patterns, we can know who’s the winner of the seller and buyer battles.

Because market psychology is reflected by two variables. The first bullish candlestick represents buyers and the second is bearish candlestick represents as a seller.

After reading the simple method of trading forex with a price action strategy, we hope we can be more flexible in reading what current trends are going so then we can look at trend following trading signals in higher low in uptrend or lower high in downtrend which combined with candlestick confirmation as our strong support resistance levels.

And in trading forex never forget about trading in good forex brokers right? then here are several of our recommended forex brokers listed in the box below that are suitable for using this simple price action trading strategy, even for scalpers or swing traders.