As we know forex laverageis one important thing to get best trade condition depending on traders trading styles. Some traders suggest to take small laverage but in the other opinion traders need high laverage so traders can trade with biggest lot contracts too to increase their profits more faster. At this situation, we choose get high laverage because we can trade with a high volume lot so we can get a maximum profit right?, but remember money management to protect trading equity still have to be counting well. Don’t forget this money management. Because actually laverage equal with drawn-down. More highest the laverage then more maximal the draw down allowed. Laverage in forex is expressed as ratios: 1:1, 1:50, 1:100, 1:200, 1:400, 1:500 and 1:1000.

As we know forex laverageis one important thing to get best trade condition depending on traders trading styles. Some traders suggest to take small laverage but in the other opinion traders need high laverage so traders can trade with biggest lot contracts too to increase their profits more faster. At this situation, we choose get high laverage because we can trade with a high volume lot so we can get a maximum profit right?, but remember money management to protect trading equity still have to be counting well. Don’t forget this money management. Because actually laverage equal with drawn-down. More highest the laverage then more maximal the draw down allowed. Laverage in forex is expressed as ratios: 1:1, 1:50, 1:100, 1:200, 1:400, 1:500 and 1:1000.

Simple Forex Margin Calculator

= $100,000/$1,000

= 100

This leverage ratio of 1:100 is translated as following:For every $1 I deposit in my forex broker’s account, my broker in return deposits $100 in my margin account. So, if I deposit $1000 then my broker deposits $100,000 in my trading account.

So with just $1000 of my own money, I can control $100,000 for my trading purposes. By doing so I created a leverage in forex.

Oanda forex margin calculator formula or forex calculator from babypips that we can use to calculate our trading risk ratio to prevent our forex accounts from margin call.

How Does Forex Leverage Work?

- Trader A has $5000 USD – If Trader A has an account leverage of 10:1 and they wish to use $1000 on one trade as margin, they will have exposure of $10,000 in base currency ($1000) = 10 x $1000 = $10,000 (trade value).

- Trader B has $5000 USD – If Trader B has an account leverage of 100:1 and they wish to use $1000 on one trade as margin, they will have exposure of $100,000 in base currency ($1000) = 100 x $1000 = $100,000 (trade value).

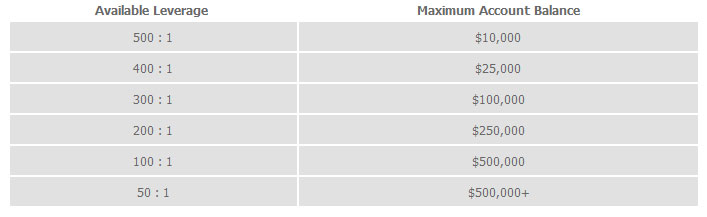

Margin Forex is very high risk and leverage should be used wisely. In order to protect you in minimizing risk, some forex brokers have leverage restrictions in place. To check how much leverage you can use on your account please review the table below:

In several brokers such TICKMILL, ROBOFOREX, IC MARKETS, JUSTFOREX, EXNESS, FUSION MARKETS, VT MARKETS, FBS, GLOBAL PRIME the laverage allowed up to 1:500 or even 1:1000 on mini / micro or in cents, or standard account type. Example we open standard forex account at INSTA with 1:1000 Laverage and $1000 trading capital. We can trade minimum open lot with 0.01lot which 1 pip equal $0.01, or if open 1.0lot 1pip equal with $1. So, then if we open 10 lot volume then (1/1000) x100% = 0.1% x 10 = 1% risk that we’ve used from our trading equity. And if we using 1:500 with 1000usd and open 10 lot volume then (1/500) x100% = 0.2% x 10 = 2% risk that we’ve used from our trading margin capital. We’ve to realize that forex leverage is a “double-edged sword” it can work for some traders or and it could be against you.  Most forex traders very like and need this high leverage and usually are given more than enough. And of course with 1:1000 laverage you have a power 1000 times to trade with this currency and metal. We’ve to wise in managing our trading margin level if we’re using high laverage, because high laverage forex accounts give the opportunity to open lot with maximum volume transactions. As long you have a great accurate trading system scenario that using stop loss it all fine then, but if you don’t have a good forex trading scenario that using stop loss level ratio or cut and switch trading trading scenario it would be dangerous to our trading capital to get margin call more faster than you imagine. Because many forex traders using high laverage in their account only for scalping. Our suggestion learn and find first a very good forex trading system scenario then you can using high laverage option. According our tested forex trading strategy, better using basics reversal candlesticks forex strategy combined with simple support resistance strategy to get fastest forex signals confirmation as our trading entry.

Most forex traders very like and need this high leverage and usually are given more than enough. And of course with 1:1000 laverage you have a power 1000 times to trade with this currency and metal. We’ve to wise in managing our trading margin level if we’re using high laverage, because high laverage forex accounts give the opportunity to open lot with maximum volume transactions. As long you have a great accurate trading system scenario that using stop loss it all fine then, but if you don’t have a good forex trading scenario that using stop loss level ratio or cut and switch trading trading scenario it would be dangerous to our trading capital to get margin call more faster than you imagine. Because many forex traders using high laverage in their account only for scalping. Our suggestion learn and find first a very good forex trading system scenario then you can using high laverage option. According our tested forex trading strategy, better using basics reversal candlesticks forex strategy combined with simple support resistance strategy to get fastest forex signals confirmation as our trading entry.