Trading forex sometimes is complicated enough. But by identifying true or false price action breakout patterns we can know what exactly the market will go. And for sure economic news is still in play before we make or take the decision to enter to forex market. And don’t forget to remember we’ve to use our lot management wisely. And here are some price action tutorials below that we can learn together. 😉

In this Forex trading lesson, I am going to share with you three of my favorite price action trading strategies; pin bars, inside bars, and false. These trading setups are simple yet very powerful, and if you learn to trade them with discipline and patience you will have a very potent Forex trading edge.

Whilst these three setups are my ‘core’ setups, there are many other versions and variations of them that we focus on in our members’ community and advanced price action trading course. However, you can learn some good basics in this article to lay the foundation for future learning. So, without further delay, let’s get this party started 😉

Pin Bar Setup:

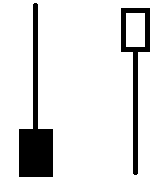

The pin bar is a staple of the way I trade the Forex market. It has a very high accuracy rate in trending markets and especially when occurring at a confluent level. Pin bars occurring at important support and resistance levels are generally very accurate setups. Pin bars can be taken counter trend as well, as long as they are very well defined and protrude significantly from the surrounding price bars, indicating a strong rejection has occurred, preferably only on the daily chart time frame. See the illustration to the right for an example of a bearish pin bar (1st bar) and a bullish pin bar (2nd bar) —>

markets and especially when occurring at a confluent level. Pin bars occurring at important support and resistance levels are generally very accurate setups. Pin bars can be taken counter trend as well, as long as they are very well defined and protrude significantly from the surrounding price bars, indicating a strong rejection has occurred, preferably only on the daily chart time frame. See the illustration to the right for an example of a bearish pin bar (1st bar) and a bullish pin bar (2nd bar) —>

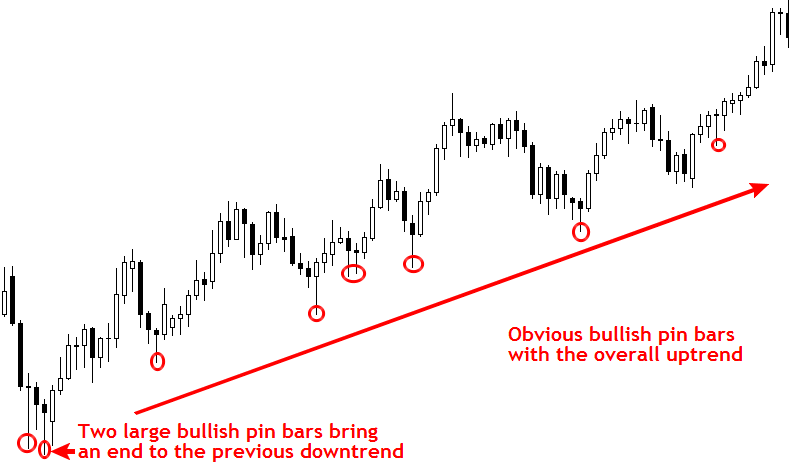

In the following chart example, we will take a look at pin bars occurring within the context of a trending market; and my favorite way to trade them. Also, note that this uptrend began on the back of two bullish pin bars that brought an end to the existing downtrend.

False Setup:

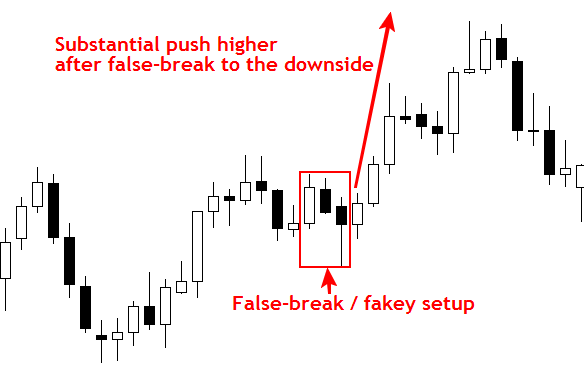

The false price break-out trading strategy is another bread-and-butter price action setup. It indicates the rejection of an important level within the market. Often the market will appear to be headed in one direction and then reverse, sucking all the amateurs in as the professionals push the price back in the  opposite direction. The false setup can set off some pretty big moves in the Forex market.

opposite direction. The false setup can set off some pretty big moves in the Forex market.

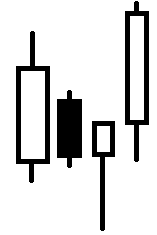

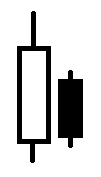

As we can see in the illustration to the right, the false pattern essentially consists of an inside bar–> setup followed by a false break of that inside bar and then a close back within its range. The false entry is triggered as the price moves back up past the high of the inside bar (or the low in the case of a bearish false).

In the chart below we can see the market was recently moving higher before the false formed. Note the false was formed on the false break of an inside bar setup that occurred as all the amateurs tried to pick the market top, the pros then stepped in and flushed out all the amateurs in a flurry of buying. 😉

Inside Bar Setup:

The inside bar is a great trend continuation signal, but it can also be used as a turning point signal. However, the first way to learn how to trade the inside bar strategy is as a continuation signal, so that is what we will focus on here, more info on the inside bar and all the ways to trade it can be found in my advanced price action trading course. As we can see in the illustration to the right, an inside bar is completely contained within the range of–> the previous bar

It shows a brief consolidation and then a break out in the dominant trend direction. Inside bars are best played on daily and weekly charts. They allow for very small risks and yet very large rewards. The inside bar strategy combined with a very strongly trending market is one of my favorite price action setups.

played on daily and weekly charts. They allow for very small risks and yet very large rewards. The inside bar strategy combined with a very strongly trending market is one of my favorite price action setups.

In the example below, we are looking at a current (as of this writing) EURUSD inside bar trade setup that has come off to the downside with the existing bearish market momentum. We can see a nice inside bar setup formed just after the market broke down below a key support level, the setup has since come off significantly lower and is still falling toward the next support at 1.2625, as of this writing.

As you can see from the three examples above, Forex trading does not have to be complicated or involve plastering messy and confusing indicators all over your charts. Once you master a few solid price action setups like the ones above and the others in my Forex trading course, you will be well on your way to becoming a more confident and profitable trader, just remember, mastering these setups will require patience, dedication, and discipline. In the end, we still need practice to find a valid “equilibrium zone” and combine it with a true pin bar before deciding on entry forex market.

How To Avoid False Breakout

Remember to analyze true or false price action breakout strategy at least in a four-hour time frame. Learn more about accurate trading using pinbar trading strategy too and happy trading!!.