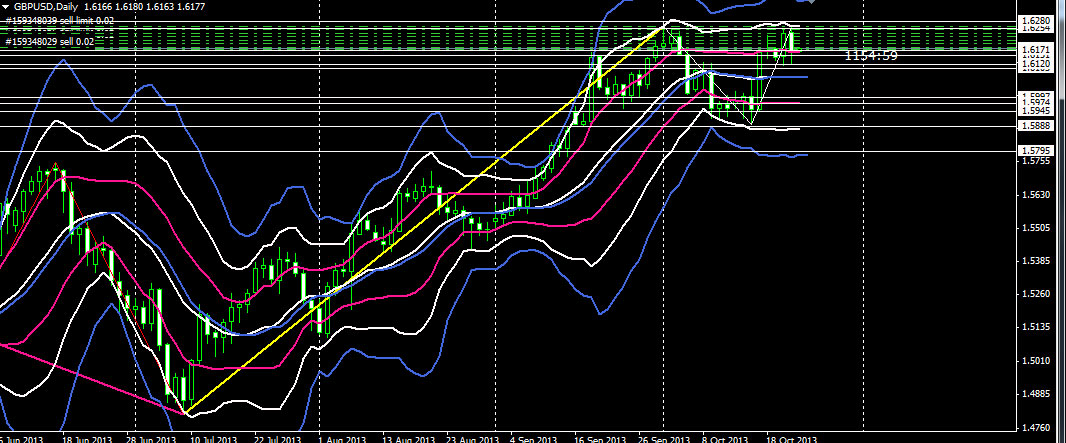

Trading With Fibonacci Retracement Strategy Trading forex with Fibonacci retracement is very helpful for calculating the range before we decide to open a position. Fibonacci retracement is very important to calculate price level to ...

[Continue reading]Technical Analysis Forex Trading With Candlestick Patterns

Easy Forex Using Candlesticks Patterns One of the top professional forex trading always using basic technical analysis forex trading with candlestick patterns. This standard analyzing usually using daily and four hour time frame. So ...

[Continue reading]Simplicity Supply Demand Trading Strategy

Supply demand trading strategy is one of my favorite trading strategies, is because in simplicity. Well in my opinion the best demand and supply levels are those that don’t have been tested at least ...

[Continue reading]Complete Collection Of Lock Profit Expert Advisor

Today i will share the complete collection of lock profit expert advisor. As a manual trader, sometime we need easy tools to take handle our trading activity as well. I mean this one of ...

[Continue reading]Very Accurate Scalping Strategies With Bollinger Bands And Zig Zag

Simple Scalping Using Bollinger Bands Confirmation Tonight I will share my tested scalping strategies with Bollinger bands and four zig zag. One of the best pairs on using this scalping strategy in eurusd,usdjpy,eurjpy. This ...

[Continue reading]Continuation Candlestick Patterns – In-Neck On-Neck & Thrusting

Bearish In-Neck, On-Neck & Thrusting Continues Patterns Strong continuation On-Neck – Medium Continuation In-Neck – Weak Continuation Thrusting We look for these bearish patterns in a down-trend within the context of continuation pattern. Don’t ...

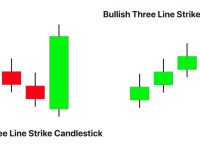

[Continue reading]Three Line Strike Continuation Candlestick Pattern

Bullish/Bearish Three Line Strike Candlestick Pattern Bullish Three Line Strike Candle Pattern [weak] We look for Bullish Three Line Strike candlestick pattern in an up-trend within the context of continuation pattern. Don’t forget, this ...

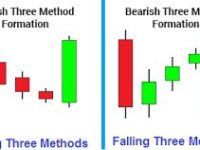

[Continue reading]Continuation Candlestick Pattern – Raising And Falling Three Methods

Today’s article is about raising and falling three methods from continuation candlestick pattern. This continuation candlestick pattern is very important on reading psychology of market cycle that we can apply in our trading rules. ...

[Continue reading]Reversal Three Inside – Outside Up and Down Candlestick Pattern

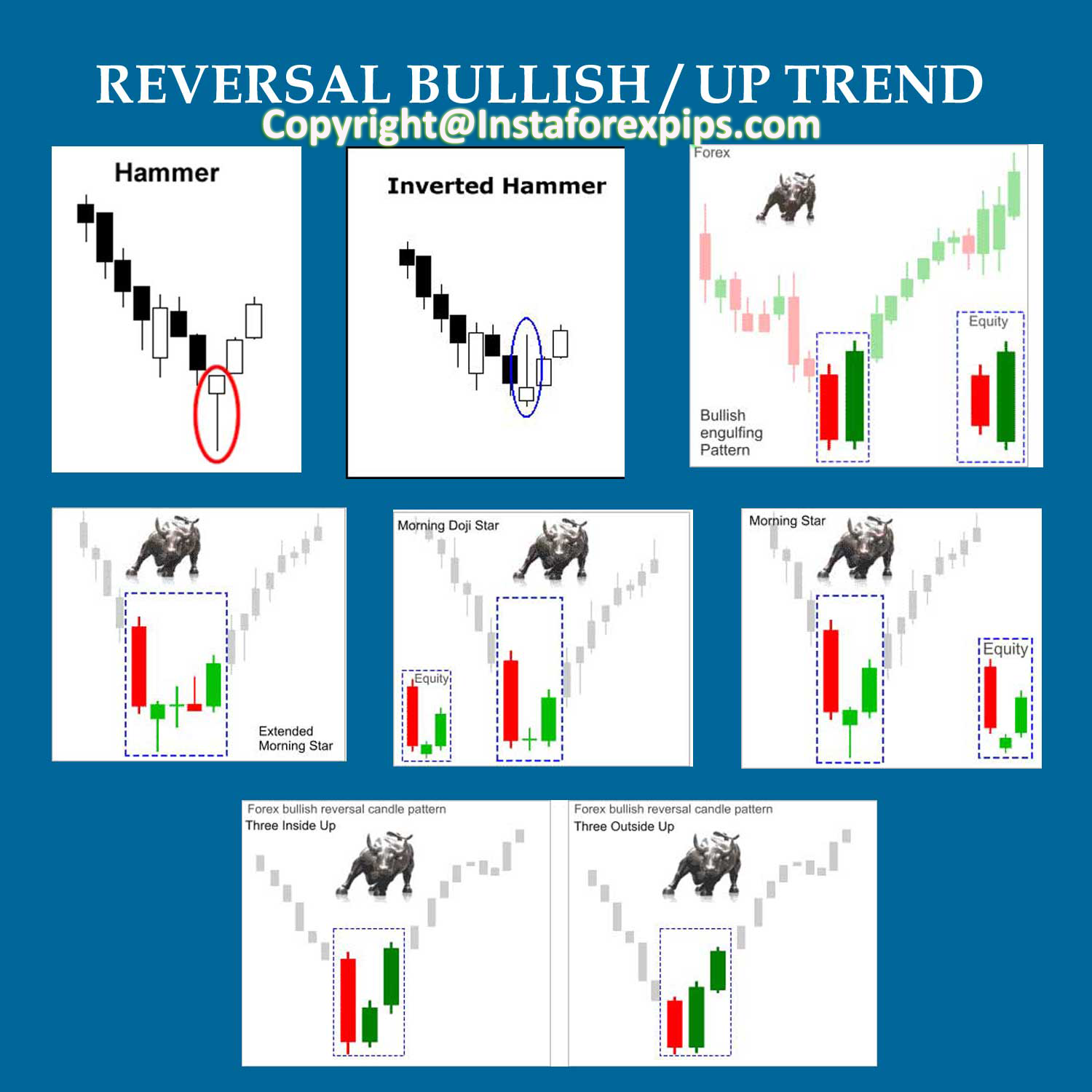

Bullish Three Inside Up – Three Outside Up We look to see these patterns on a down-trend. Bullish three inside up candlestick pattern: Last candle of the downtrend is a large bear candle. Of ...

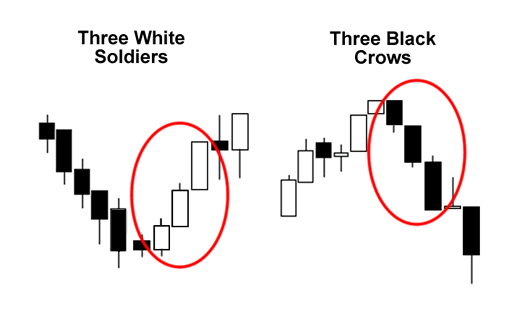

[Continue reading]Reversal Three White Soldiers & Black Crows Candlestick Pattern

Bullish – Three White Soldiers Candlesticks Pattern And Bearish – Three Black Crows Candle Pattern We have another couple of reversal candlestick patterns with an interesting names. While the bullish version of the same ...

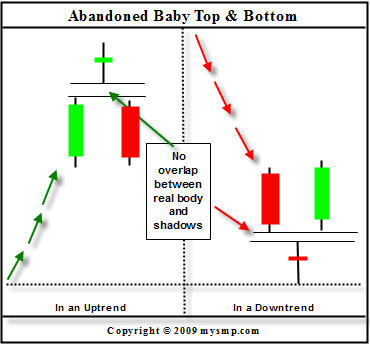

[Continue reading]Abandoned Baby Candlestick Pattern

Bullish and Bearish Abandoned Baby Candle Pattern Lets start with engulfing pattern which is considered to be most strong of all in the right place. Who’d want to abandon their baby? I don’t think ...

[Continue reading]Bullish And Bearish Engulfing Reversal Candlestick Pattern

Bullish / Bearish Engulfing Candlestick Patterns Remember in using this engulfing bullish or bearish candlestick pattern that should be located on supply demand zone. Lets start with engulfing pattern which is considered to be ...

[Continue reading]Trading Price With Supply Demand Strategy

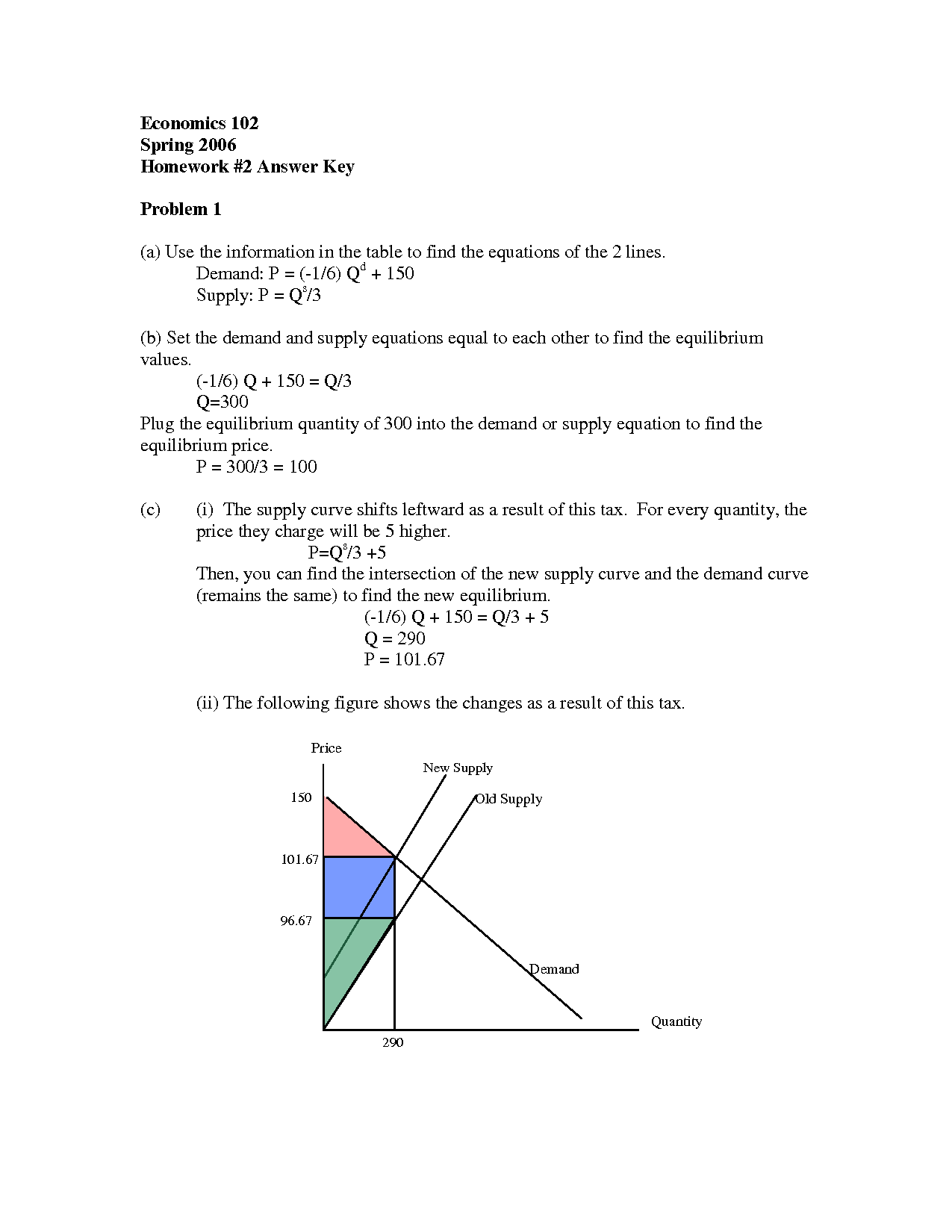

Trading price with supply demand curve is very nice to learning. Basic concept of this supply demand strategy is how we look supply demand area with two line nearest based two lower low or ...

[Continue reading]Unbelievable Easy Forex Trading Strategy With No Indicators

Supply demand strategy is the simple and easiest way on trading forex. Because this is the heart of economy market which there is goods and services so both of this component made a value. ...

[Continue reading]Supply Demand Trading Concept With Continuation And Reversal Candlestick Pattern

Supply Demand Trading Concept Still Need To Be Filtered With Candlestick Patterns Forex trading sometimes is very complicated.Even some traders loss almost their all saving money. Why it can be happened? It’s because some ...

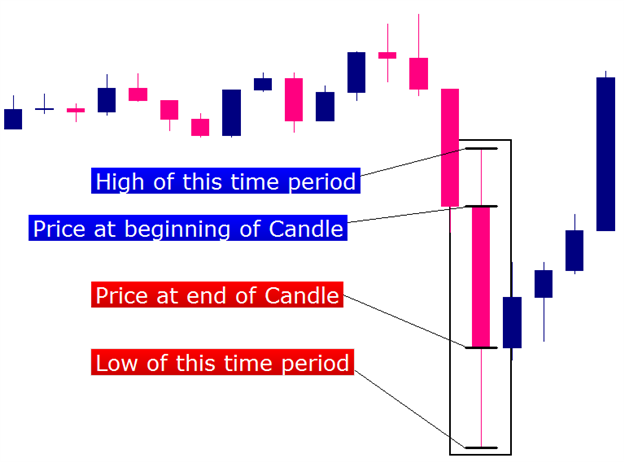

[Continue reading]Forex Candlestick Basics That We Must Understand

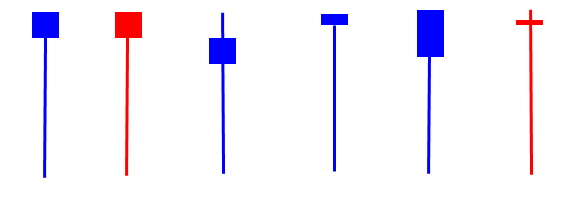

Let Candlestick Tells On Us About The Price From our experience in trading forex, this candlestick patterns cannot be forget from our variable analysis. This forex candlestick basics can be read on best time ...

[Continue reading]Pin Bar Forex Strategy Part 2

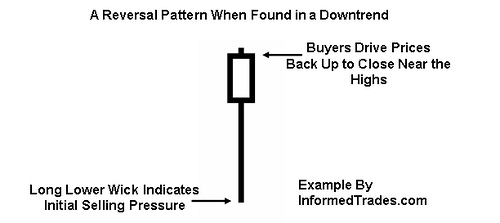

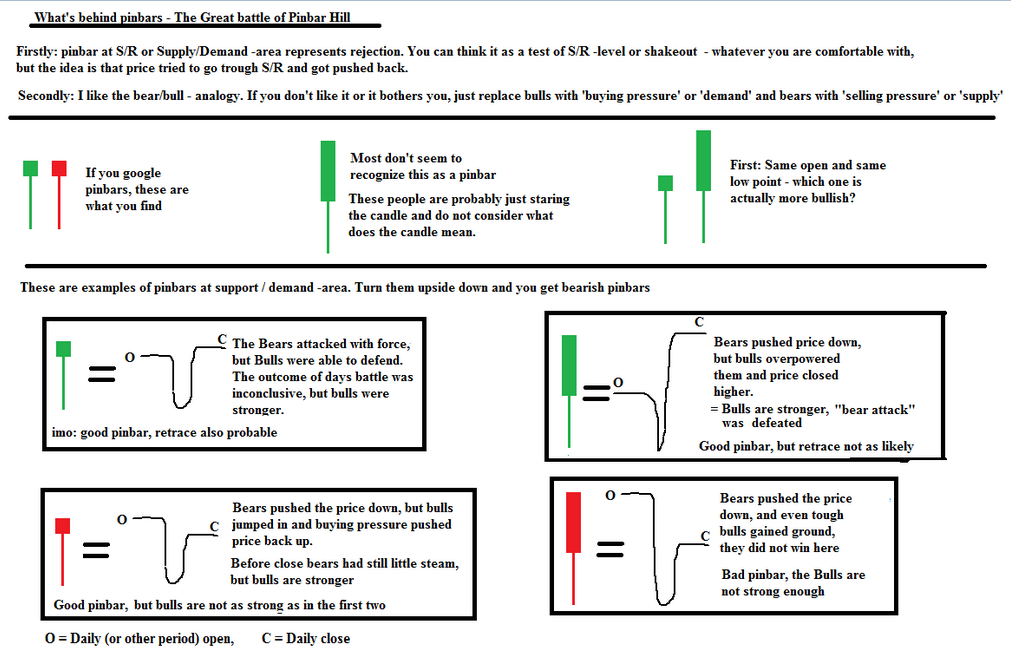

Pin Bar is a popular forex strategy which is based on the particular candlestick pattern. You can use this strategy on any major pairs and timeframe. Using longer-term timeframes would be more logical though. ...

[Continue reading]The Best And Simple Trade Copier Forex Expert Advisor

Sometimes we need best and simple ways to get trade copier forex expert advisor. By using this software we can copy trade from meta trader master and paste trade into meta trader slave as ...

[Continue reading]Trading Forex With Reversal Candlestick Patterns

Trading forex with a reversal candlestick patterns are always made easy almost for all traders. Why ? Because trading forex with reversal candlestick patterns give us simplicity and clearly in analyzing the market volatile. ...

[Continue reading]How To Trade With Pinbar Based Price Action Strategy

Some forex traders maybe didn’t know which valid pinbar to trade with. I mean trade with pinbar have to be filtering with right support resistance. But, which time frame we have to drawn support ...

[Continue reading]How To Get Stable And Fastest Internet Connection On Our Metatrader 4.0

Some times we need to know ip address number from our server that we used on our platform. Which mean we need a stable connection from our metatrader platform to server broker right. So, ...

[Continue reading]Recent False Price Action Setups and Pin Bar Reversal Forex Trade Setups

Hey Forex Traders, I just wanted to point out some nice trades that had formed recently on the EURUSD and GBPUSD. Below are some charts with classic examples of some of my price action ...

[Continue reading]Pin Bar Candlestick Forex Trading Strategy

An Explanation To The Pin Bar Forex Trading Strategy and How to Trade It Effectively The pin bar formation is actually a price reversal pattern consisting of three bars. Once familiarized with pin bar ...

[Continue reading]Price Action Chart Patterns: Pin Bars, False Breakout, Inside Bars

Trading forex sometimes is complicated enough. But by identifying true or false price action breakout patterns we can know what exactly the market will go. And for sure economic news is still in play ...

[Continue reading]