Sometimes forex indicators are very important to take action for a scalpers or swing forex in getting best forex momentum trading signals as soon as possible. In this article we’ll share non lagging or non repainting forex indicators that worthy to try as our trading signals confirmation. Is because some forex traders still need forex indicators as confirmation before made a decision to entry positions to the forex market. Almost of forex scalpers using one minute, 5 minutes, 15 minutes, 30 minutes or maximum using one hours time frame confirmation as a signals on their forex analysis.

Sometimes forex indicators are very important to take action for a scalpers or swing forex in getting best forex momentum trading signals as soon as possible. In this article we’ll share non lagging or non repainting forex indicators that worthy to try as our trading signals confirmation. Is because some forex traders still need forex indicators as confirmation before made a decision to entry positions to the forex market. Almost of forex scalpers using one minute, 5 minutes, 15 minutes, 30 minutes or maximum using one hours time frame confirmation as a signals on their forex analysis.

Even most of forex indicators is lagging or delay to give a signals but some forex indicators like stochastic combined with macd convergence or divergence very accurate enough for scalpers.

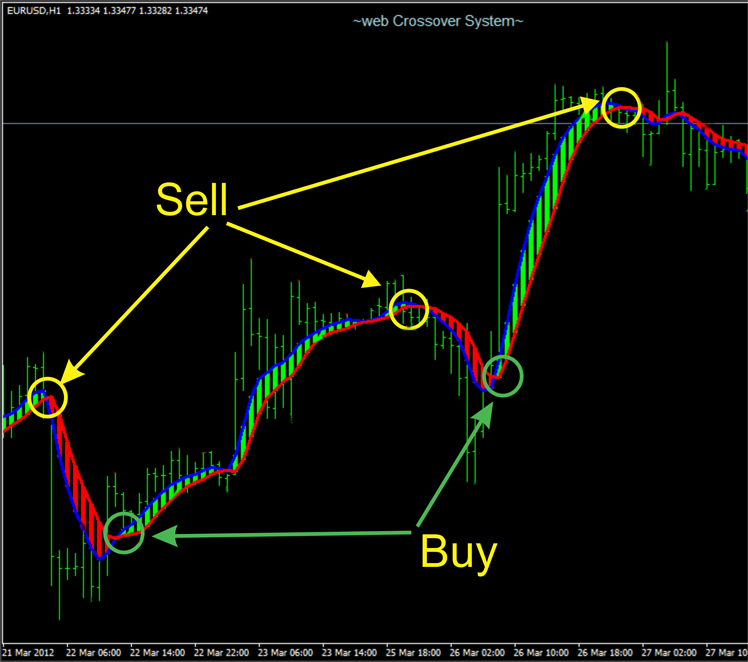

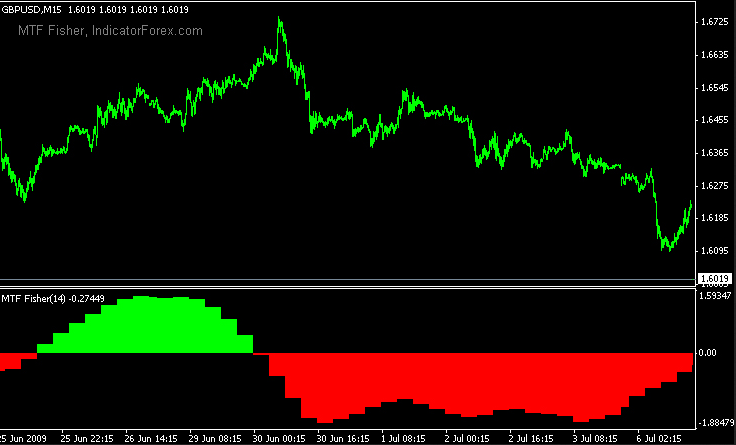

See this pictures below which using in daily time frame and looking for best signals in 5 minutes or 15 minutes chart.

So, when we choose forex indicators we’ve to know first what about the function from forex indicators it self. And most forex indicators only works on small time frame, so because of this many traders looking the best scalping forex indicators. One of best and simple forex indicator is moving average combined with ichimoku or bollinger bands combined it with zig zag. But, the main point in how we use forex indicators is depending what type are we, are we scalpers or swing traders.

We’ve to choose forex indicators based on our target too. Example : If our target only 1-15pips of course we only need cross moving average with low period on each line of moving average and waiting for a cross and take action based on convergence divergence of MACD. Or we can use accurate scalping strategy based Bollinger bands cross zig zag or practice with support resistance strategy and waiting for the best forex signals using reversal candlestick strategies in small time frame 15 or 30 minutes time frame it would be help us as become a professional forex trader. And if we are swing traders, usually target 30pips above, so we should understand first about how to reading supply demand zone as our strong support resistance levels and combined it forex candlestick basics strategy. That’s it.

Lastly, how we used forex indicators it depend on our trading strategy it self and our target pips, and remember choose forex indicators that have a good reputation on it. Usually this method it will works. Tips from us : never use forex indicators more than 5 forex indicators it would be complicated in our analysis. And the best forex indicator is only strong support resistance level and combined with reversal forex candlestick patterns as our confirmation forex signals and use at least daily time frame to read current major trend that running. Because as we know forex candlestick patterns strategy works almost for 200 years and all professional forex traders approved that candlestick patterns are always needed in their forex trading variable analysis. This is the best ways to start trading forex in order to make a good forex journal and to get consistent profit monthly and this is the one of forex strategy that no indicators needed and never using buy sell arrows as our trading signals even the sellers said like that.. never.

Or we can using strong correlation trading concept on each pairs it self. Example : GBPUSD , it means GBP versus USD right. So if more pairs with GBP symbol [GBPJPY, GBPCHF, GBPAUD, etc.] have a strong bullish signals it would be strong bearish signals on USD pairs like USDJPY, USDCAD, etc. Many forex traders call this “Correlation Pairs Strategies”. Those forex trading concept are just simplest ways to practice our learning on how forex indicators sometimes works in market movement scenario. And lastly in our opinion candlesticks it self is the best no repaint forex indicators and we’ve hope this article about study forex indicators can guide us in how we choose which best forex indicators that suitable for us on getting wealth income. You can download our several non lagging and non repaint forex indicators here. And always remember that using our recommended forex brokers from our list in the box below.

CONCLUSION

Learn and practice how to read support resistance with multiple key level. More key level, more better become support resistance level, and confirmation key level tell us this is true support resistance level it self and breakout and the breakout must follow confirmation as we called a momentum. This momentum or confirmation can be as bullish and bearish engulfing pattern, hammer or shooting star or pin bar with long wick or sometimes breakout form with three dark crow and three white soldiers. That’s why we need understanding reversal candlestick patterns works. And don’t forget learn too about how trading with liquidity zone and combined it with trading support and resistance breakout trading strategy.