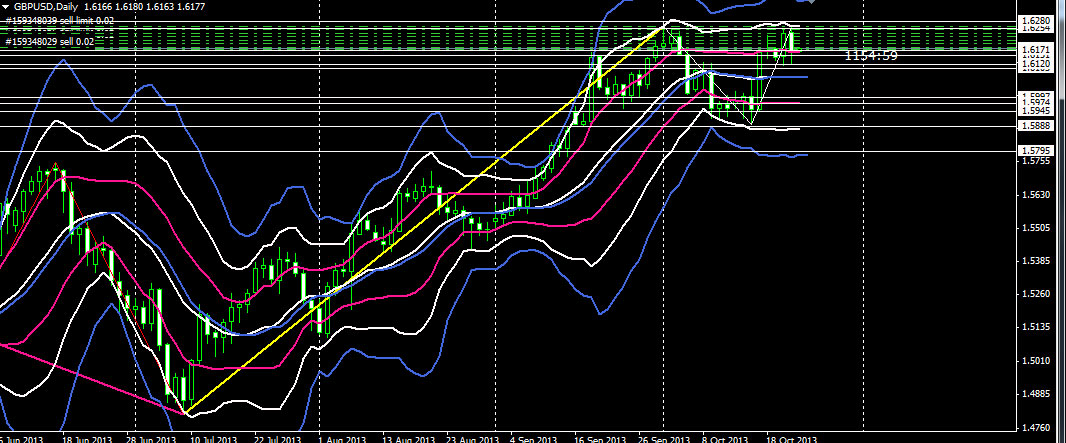

Easy Forex Using Candlesticks Patterns One of the top professional forex trading always using basic technical analysis forex trading with candlestick patterns. This standard analyzing usually using daily and four hour time frame. So ...

[Continue reading]Category: Candlestick Basics

Candlestick patterns as confirmation valid signals

Continuation Candlestick Patterns – In-Neck On-Neck & Thrusting

Bearish In-Neck, On-Neck & Thrusting Continues Patterns Strong continuation On-Neck – Medium Continuation In-Neck – Weak Continuation Thrusting We look for these bearish patterns in a down-trend within the context of continuation pattern. Don’t ...

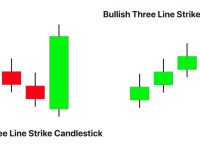

[Continue reading]Three Line Strike Continuation Candlestick Pattern

Bullish/Bearish Three Line Strike Candlestick Pattern Bullish Three Line Strike Candle Pattern [weak] We look for Bullish Three Line Strike candlestick pattern in an up-trend within the context of continuation pattern. Don’t forget, this ...

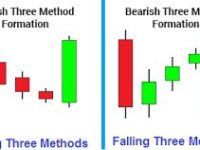

[Continue reading]Continuation Candlestick Pattern – Raising And Falling Three Methods

Today’s article is about raising and falling three methods from continuation candlestick pattern. This continuation candlestick pattern is very important on reading psychology of market cycle that we can apply in our trading rules. ...

[Continue reading]Reversal Three Inside – Outside Up and Down Candlestick Pattern

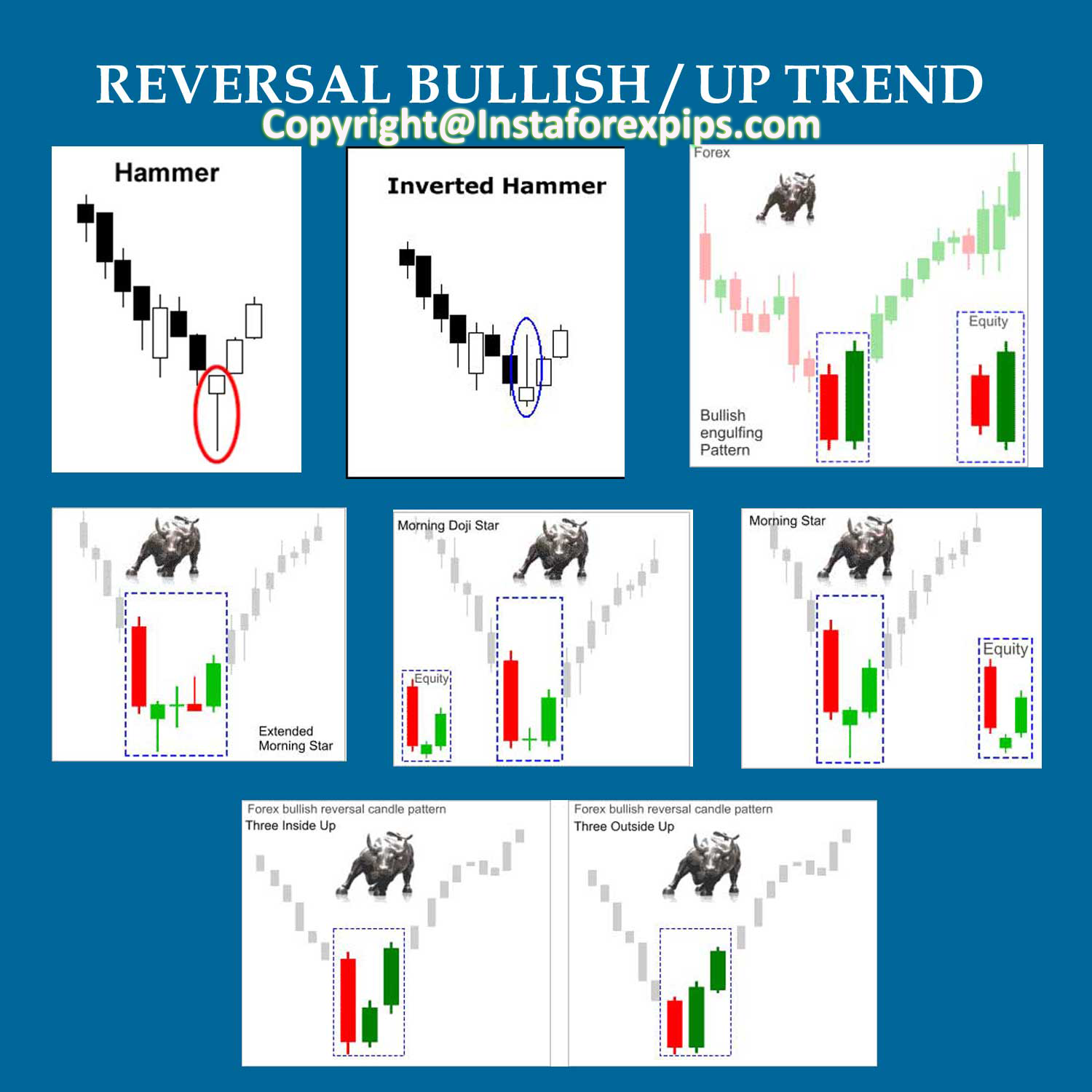

Bullish Three Inside Up – Three Outside Up We look to see these patterns on a down-trend. Bullish three inside up candlestick pattern: Last candle of the downtrend is a large bear candle. Of ...

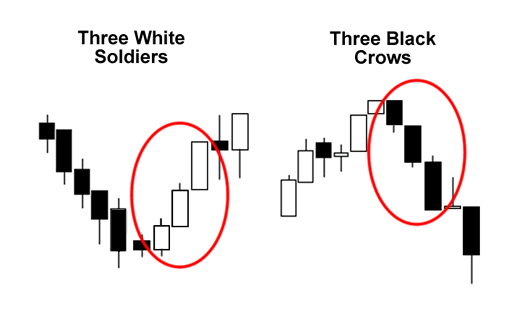

[Continue reading]Reversal Three White Soldiers & Black Crows Candlestick Pattern

Bullish – Three White Soldiers Candlesticks Pattern And Bearish – Three Black Crows Candle Pattern We have another couple of reversal candlestick patterns with an interesting names. While the bullish version of the same ...

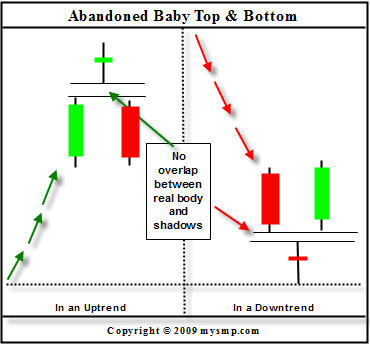

[Continue reading]Abandoned Baby Candlestick Pattern

Bullish and Bearish Abandoned Baby Candle Pattern Lets start with engulfing pattern which is considered to be most strong of all in the right place. Who’d want to abandon their baby? I don’t think ...

[Continue reading]Bullish And Bearish Engulfing Reversal Candlestick Pattern

Bullish / Bearish Engulfing Candlestick Patterns Remember in using this engulfing bullish or bearish candlestick pattern that should be located on supply demand zone. Lets start with engulfing pattern which is considered to be ...

[Continue reading]Supply Demand Trading Concept With Continuation And Reversal Candlestick Pattern

Supply Demand Trading Concept Still Need To Be Filtered With Candlestick Patterns Forex trading sometimes is very complicated.Even some traders loss almost their all saving money. Why it can be happened? It’s because some ...

[Continue reading]Forex Candlestick Basics That We Must Understand

Let Candlestick Tells On Us About The Price From our experience in trading forex, this candlestick patterns cannot be forget from our variable analysis. This forex candlestick basics can be read on best time ...

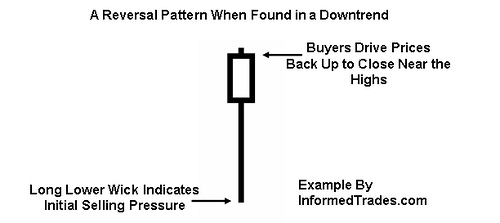

[Continue reading]Trading Forex With Reversal Candlestick Patterns

Trading forex with a reversal candlestick patterns are always made easy almost for all traders. Why ? Because trading forex with reversal candlestick patterns give us simplicity and clearly in analyzing the market volatile. ...

[Continue reading]