Forex trendline breakout trading strategies like this are always in great demand. It is quick, easy, and with proper use has a true winning rate of over 80%. Pair: GBP/USD, EUR/USD – tested. Other pairs may also be used.

Forex trendline breakout trading strategies like this are always in great demand. It is quick, easy, and with proper use has a true winning rate of over 80%. Pair: GBP/USD, EUR/USD – tested. Other pairs may also be used.Time frame: 1 hour.

Indicators: none.

Trading setup:

For this Forex system to work properly a trader needs to know the basics of identifying swings high and low, the rules of drawing trend lines, plus be able to use Pivot Points.

These are very simple things we believe every trader should know.

Our working range includes 5 candles: from midnight to 4:00 am EST (including the 4:00 am candle).

Optionally: draw a midnight vertical line for a visual aid.

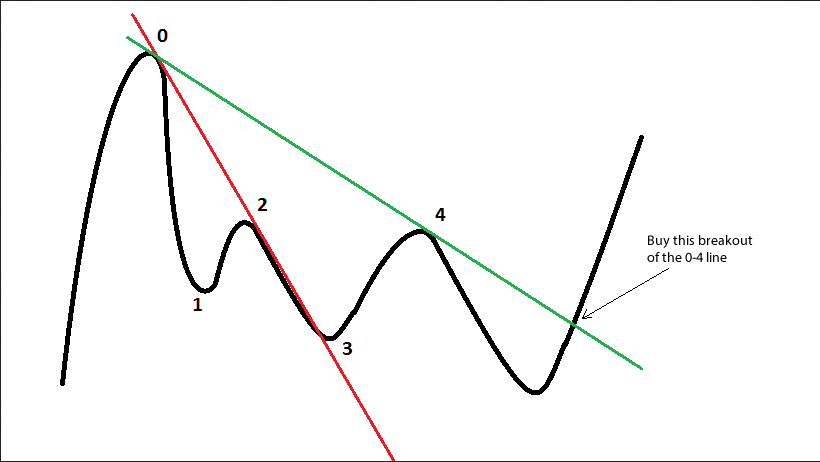

Within those 5 candles look for a valid swing high and swing low of the price.

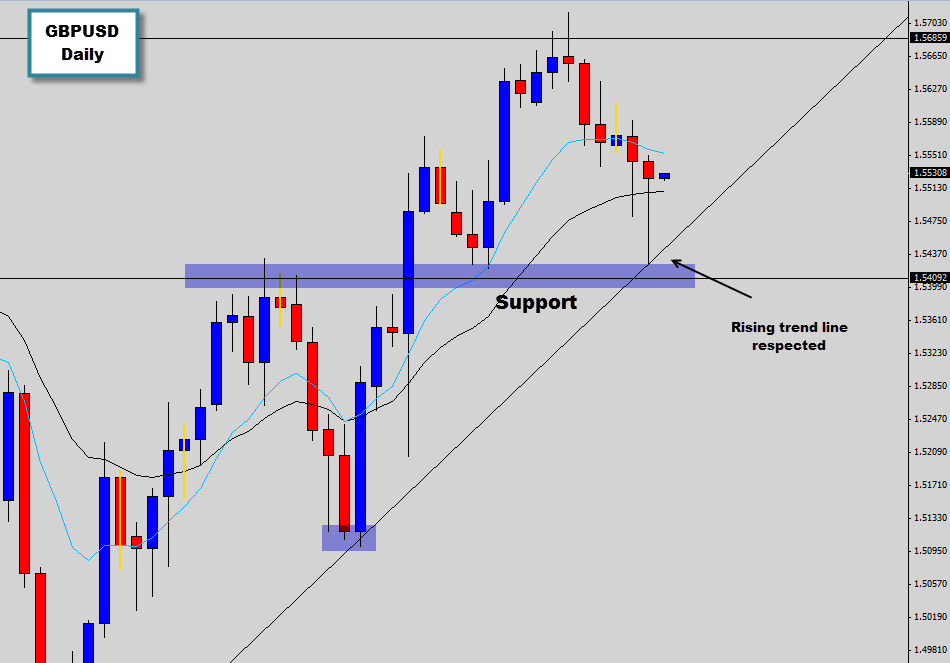

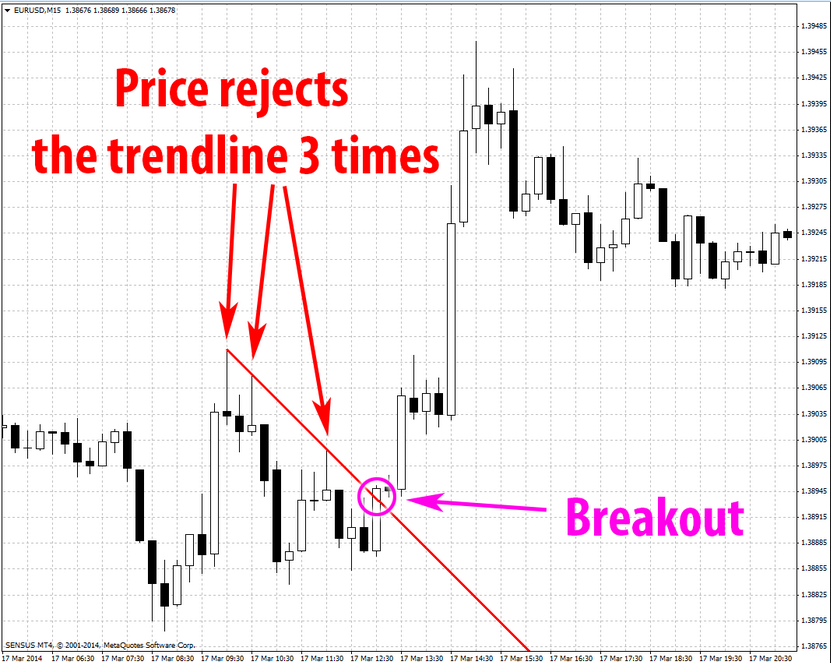

Now, draw a downtrend trend line connecting your swing High to the most recent swing High of the previous day. (Make sure the last one is also a valid High to draw a downtrend trend line through).

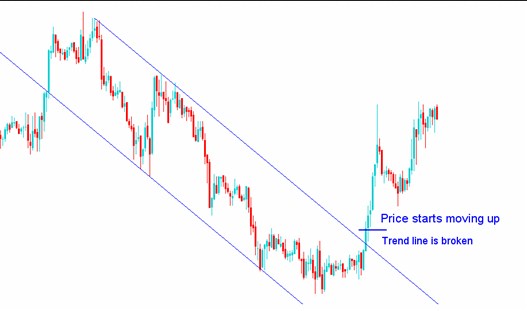

Do the same for the swing Low: connect it to the most recent swing low of the previous days, and make sure you are pulling the right trend line using the rules of drawing Uptrend trend lines this time.

If a trader sees, for example, no swings High in the 5-candle range, that means there will be no downtrend trend lines this morning. Same for a swing Low.

The Entry is done on the break of either one of the trend lines and is immediate without waiting for a current candle to close. A protective stop is placed just above/below the candle that broke through the trend line.

Profit target:

Usually the whole action is unfolded within the next three candles (count in the candle that had violated the trend line but only if it closed on the other side of the trend line).

So, after the actual breakout, we have 3 hours or 3 candles to trade, after that we will exit with whatever profit is made.

Main rule: Using Pivot points + timing

Our profit target is going to be the nearest level of support or resistance according to Pivot point levels.

If, however, after only one candle (or 1 hour) this target is reached, it suggests a very strong market, thus we would stay in a trade longer and set our goal for the next support/resistance level. We would also choose the second Pivot point level of support/resistance as our profit goal if the first Pivot level appears to be too close to our entry point.

We have three candles to trade after the breakout in total, that’s why we can trade calm and allow our goal to shift to the next Pivot Point level.

It is an absolute trader’s discretion whether to set the target at the nearest Pivot point support/resistance level and leave the trade once the target is hit or use the timing factor exit after the two/maximum of three consecutive candles.

Tip: running two orders can save lots of nerves. First target – the nearest Pivot point as support/resistance level. Second – on the close of the third candle.

Another simplified option would be with fixed targets and timing:

For example, EUR/USD target = 20 pips minus spread, GBP/USD = 40 pips minus spread. These are only suggestions, and for other currency pairs = testing will tell…

Hold the position open for the next three candles.

If the target is not reached within those three candles, close all trading positions anyway.

That’s it. Simple and very effective right?

Here is a reference to avoid false breakout too.

Learn about The Most Profitable Liquidity Trading Strategy That You Will Ever Need !!

This method can be applied after the support resistance level has broken out, that is liquidity level by the way.

Happy Practice Using Trend lines breakout system all the way.