Forex scalping is an easy and safe way to trade forex as long as using trend following trading concept from a big time frame but it has a big risk in forex scalping strategy if using counter trend strategy to enter the forex market. Sometimes forex scalping is similar to intraday forex trading because pips usually can catch from 5-25 pips even more. Some forex scalpers only use MACD and stochastic as oversold or over-bought market indicators to enter positions in the forex market, In the end, money management still to be the one of very good strategies to minimize the risk even though we use a very accurate forex trading system.

Forex scalping is an easy and safe way to trade forex as long as using trend following trading concept from a big time frame but it has a big risk in forex scalping strategy if using counter trend strategy to enter the forex market. Sometimes forex scalping is similar to intraday forex trading because pips usually can catch from 5-25 pips even more. Some forex scalpers only use MACD and stochastic as oversold or over-bought market indicators to enter positions in the forex market, In the end, money management still to be the one of very good strategies to minimize the risk even though we use a very accurate forex trading system.

|

|

Forex Scalping brokers always have a big effect with this scalping forex strategy right? I recommend using ICMARKETS, FUSION MARKETS, VT MARKETS, TMGM, TICKMILL, EXNESS, ROBOFOREX, and another best forex brokers in the box at the end of this article, you can open a live forex account in one of those with 1:500 or 1:1000 leverage and open mini account forex type as our trading account. There are many types of scalping forex strategies that are published on the internet. Sometimes we can confused about how to choose which one is best from the forex scalping strategy. Some professional forex traders suggest that traders have to practice more about using this forex scalping strategy using high low prices in the past. You can use an accurate trend-following forex trading strategy based on Bill Williams or chaos forex strategy to read current major trends in a big time frame and apply on a 5-minute chart to get the best forex signals as fast as possible. You can that system as a scalping trading strategy, intra-day forex strategy or even better use as our swing trading system to get consistent profit.

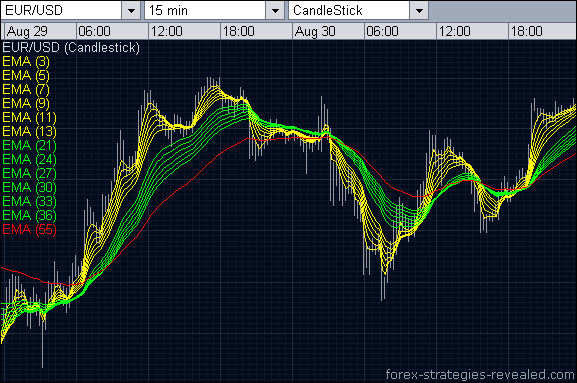

So, the main point of this forex scalping strategy is only to see the ongoing trend in the big time frame as our big trend. We can trade on a 5-minute chart or 15-minute time frame for an easy way to start our practice of this forex scalping strategy. The key is more indicators that we used as our variable analysis so it is more accurate than the forex signals that we’ll get. And lastly, combining this scalping with forex economic indicators is a must.

And stay away from big economic news like non-farm employment change, FOMC statements, or interest rate statements in using this scalping strategy because if that forex economics news it will have a big impact on market volatility. Usually have a big move of more than 100 pips, the best forex strategy is a forex strategy that has a stop loss level in the right place. That’s why we still need to see the economic calendar from the forex factory to see the timing from economic news that has a big impact on the forex market. Take a look at my picture below, and test it trade with this system. Happy trades 😉

This forex scalping strategy is very effective in Asia or London trading sessions. More than 70% accurate. But remember we’ve to be wise to calculate lot management strategy right? Never forget risk is always equal to reward. This forex scalping method is similar to supply demand strategy. Test trading on demo first before taking action into our real account, and we’ve to cut and switch if suddenly trend market changes. This is one of the best methods of trading forex to get minimum risk.

Scalping Forex Indicators No Repaint / Non-Lagging

My best trading recommendation about forex scalping is to use the reversal candlestick strategy and use this candlestick pattern strategy as our true range or true area of support resistance. So, then we can be more accurate in getting forex signals. Read our article about accurate forex support resistance strategy.

Maybe if you’re looking for a forex scalping indicator, you can use waddah-attar as your scalping forex indicator as seen in the picture above.