Types Of Forex EA

Forex expert advisor is very important for professional traders. Even some institutions bought automatic forex trading software at expensive prices. Why Forex robot very important?

Here are some advantages of trading forex using forex automated software called Forex Robot that we can get :

- 24/5 works for you, it means just installing Forex expert advisor on your VPS, set, and no need to take all day long or all night long in front of your laptop to analyze Forex chart patterns.

- No emotion, it means we can moderate lot size management based safe, moderate, or extreme depending on the forex expert advisor setting parameters

- Never missed the signal to enter and exit from the forex market of course.

Forex expert advisors have many types based on specific forex trading strategies. There are martingale, averaging, scalping, locking, trapping, intraday trading strategies, and swing with a long-term strategy, and some based on neural networks or even there are arbitrage trading systems. But after years of studying forex, I realize the best of the best forex trading techniques is using multi-timeframe analysis using reversal Japanese candlestick patterns as our base support resistance. So in the end I think manual will be better if we compare then automated trading software.

But, sometimes martingale, scalping, and other forex strategy even give us more profit too. Each forex trading strategy has a different profit-loss ratio. Example: martingale is faster to create some pips than averaging or scalping but the risk is always significant from reward right?

We need to realize what type of trader we are. Is scalping traders? martingale traders or swing traders? If we’ve found safety traders we need to search for an averaging forex expert advisor that is suitable for you.

Automatic Trading Methods for Daily Profits

Forex robots employ various automatic trading methods to gain daily profits. These methods include:

Here is a little explanation about the type from Forex expert advisor :

- Martingale forex strategy; It would be open double size lot or even triple size lot on each level price usually ranges based on several pips. Martingale robots use a “double down” strategy, where the robot doubles the trade size after a losing trade. The goal is to recover the losses from the previous trade and make a small profit. However, this strategy can be highly risky, as it can lead to significant losses if there are consecutive losing trades.

- Hedging forex strategy; It would be open orders buy and sell at the same time usually using a combination of martingale trading rules with pending buy and sell limit orders based on 10-30 pips and after hitting one of the pending limits then another limit orders will canceled and modify to new 10-30 pips based new cycles all the time until all open orders are clear and start over again and again because hedge forex trading strategy have a goal to get profit more faster in one cycle and it happen again and again but hedging forex usually works in ranging forex markets condition. Hedging robots are designed to open buy and sell positions on the same currency pair simultaneously. The idea is that the winning trade will offset the losses from the losing trade. While this strategy can reduce risk, it also limits the profit potential, as the robot is essentially trading in a net-zero position. While this strategy can reduce risk, it also limits the profit potential, as the robot is essentially trading in a net-zero position.

- Averaging forex strategy; This means trade is always open with a fixed lot based on several pips based on each signal on the current major trend. Averaging robots, also known as a grid or martingale systems, work by opening additional trades in the same direction as the initial losing trade. The idea is that the combined profit of all the winning trades will offset the losses from the losing trade. However, this strategy can be risky and may lead to significant drawdowns if the market moves against the open positions.

- Scalping forex strategy; This means trade only takes several pips but with big lot size, usually not in news time or only in Asia and sideways session. Scalping robots are designed to make quick, short-term trades to exploit small price movements. They aim to achieve small profits on numerous trades throughout the day. These robots typically operate on lower timeframes, such as one or five minutes, and require a broker with low spreads and fast order execution to be effective. Scalping robots aim to profit from small price movements by executing a large number of trades in a short period. They typically target a few pips of profit per trade and may hold positions for only a few seconds or minutes.

- Hedging-Martingale Combinations. Some forex robots combine hedging and martingale strategies to mitigate risk and maximize profit potential. These robots use a combination of hedging to reduce risk and martingale to recover losses. However, it’s important to note that this combination strategy can be complex and requires careful risk management to avoid significant drawdowns.

Sometimes we need to use forex EA for our trading activity, for example, if we want to close only profit or only loss or even if we want to close all open orders and all pending orders with only drag forex EA to main chart and enable it. Then all open orders will close in seconds. Just for reference, you can study many forex EA lists at www.mql5.com/en/market/mt4/expert. There are so many expert advisors with martingale, averaging, and scalping on several swing forex expert advisors in there.

Sometimes we need to use forex EA for our trading activity, for example, if we want to close only profit or only loss or even if we want to close all open orders and all pending orders with only drag forex EA to main chart and enable it. Then all open orders will close in seconds. Just for reference, you can study many forex EA lists at www.mql5.com/en/market/mt4/expert. There are so many expert advisors with martingale, averaging, and scalping on several swing forex expert advisors in there.

Forex robots, also known as expert advisors (EAs), are automated trading systems that use algorithms to execute trades in the forex market. These robots are designed to identify trading opportunities and can be programmed to implement various trading strategies. There are several types of forex robots, each with its unique approach to trading. Let’s explore the different types of forex robots and how they work to gain daily profits.

Technical Analysis

Forex robots use technical indicators and chart patterns to identify trading opportunities. For example, a robot may use moving averages to determine the direction of the trend and execute trades accordingly.

News Trading

Some robots are programmed to trade based on economic news and data releases. They may execute trades automatically when certain key economic indicators are announced, such as interest rate decisions or employment reports, FOMC statements, and Non-Farm Payroll.

Grid Placement Robots

That use grid placement strategies place buy and sell orders at set intervals above and below the current market price. As the price moves, the robot may open additional trades to capture profits from the price fluctuations.

Backtesting and Optimization

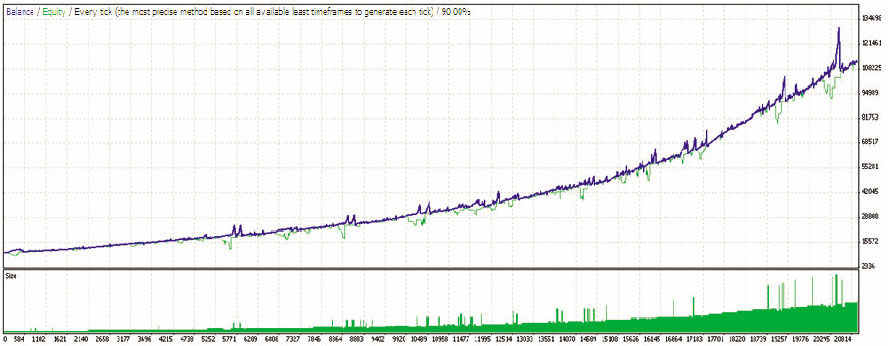

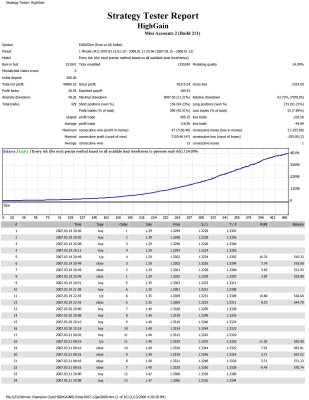

Many forex robots allow traders to backtest and optimize their trading strategies using historical data. This helps traders assess the performance of the robot under various market conditions and make necessary adjustments to improve its profitability

In conclusion, forex robots employ a variety of trading strategies and automatic trading methods to gain daily profits in the forex market. While these robots can be powerful tools, it’s important for traders to thoroughly understand the risks and complexities associated with each type of robot and to use them responsibly as part of a well-rounded trading strategy. Additionally, traders should carefully evaluate the performance and features of forex robots before incorporating them into their trading activities.