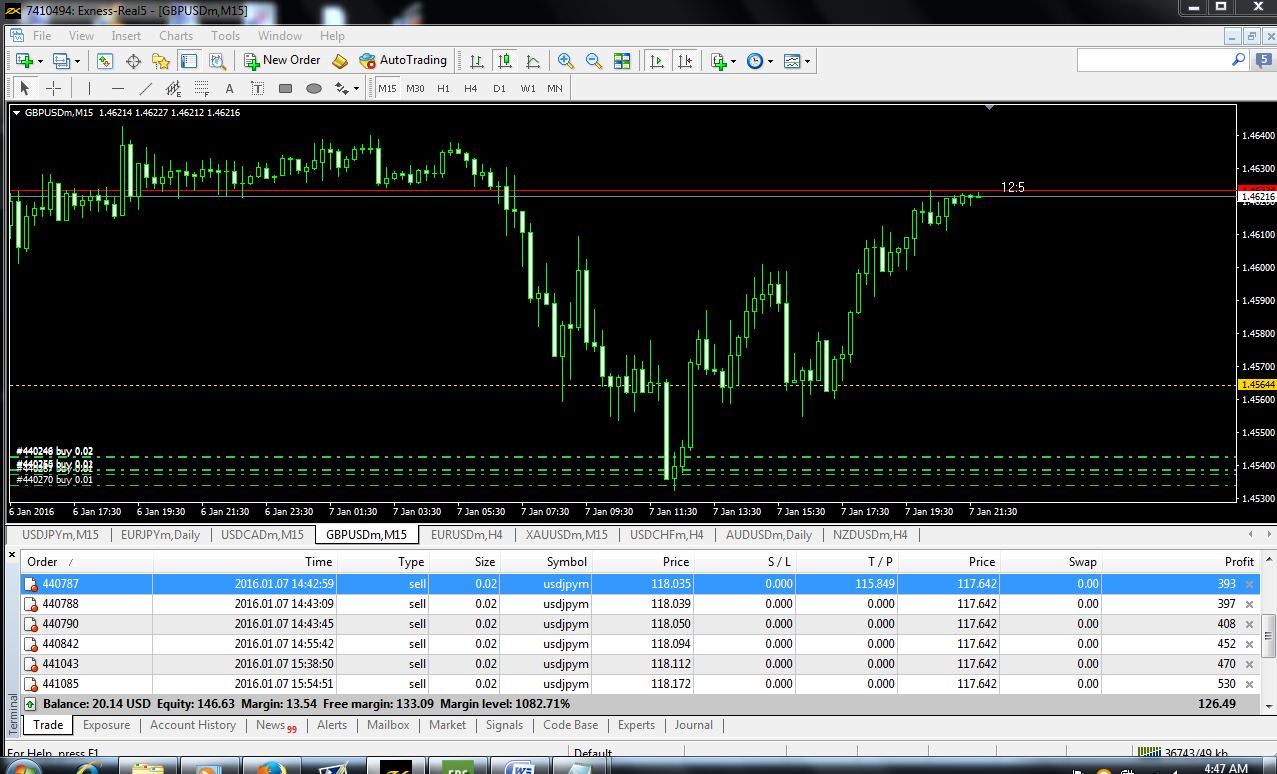

Forex averaging strategy is a very good strategy if we can identify a strong reversal zone as our averaging area and use tight money management. Why? is because several open positions places with some difference pips at reversal or swing level area or some traders said as support resistance zones. A lot of forex traders use this averaging forex trading system to get minimum risk and get more profit faster. But averaging needs a high-leverage forex account of at least 1:500 and good forex brokers with low or fixed spread of course. The key to successful averaging forex strategies is a zone that we’ve used to average our open orders. But before we average our trading order, the confirmation change of character by price action is a must and this happens in a small time frame. If we are wrong in measuring a strong reversal level, our Forex account gets a margin call so stop loss is always needed. But, if we know the limits to put stop loss it will be safe. So, how do we measure the non-lagging area with high accuracy? As forex traders, we have to research some strategy to get this “gold” area which has at least 80% accuracy or even 90% accurate signal right? There are many good forex strategies to read this strong level zone as a reversal area. We can use pin bar confirmation forex strategy, Fibonacci reversal levels combined with Japanese forex candlestick reversal patterns, forex breakout chart patterns strategy, or only using support resistance level. Based on our research, these liquidity zone which getting from the big time frame and waiting for the confirmation price action in a small time frame is very good enough. This method can be watched on video at the end of this article. Besides price action confirmation as momentum, we can use the three strategies below that we can use as our momentum confirmation, and this confirmation signal must happen in the small time frame and still in the liquidity zone for sure.

How to Identify Strong Level Reversal Zone As Our Averaging Based?

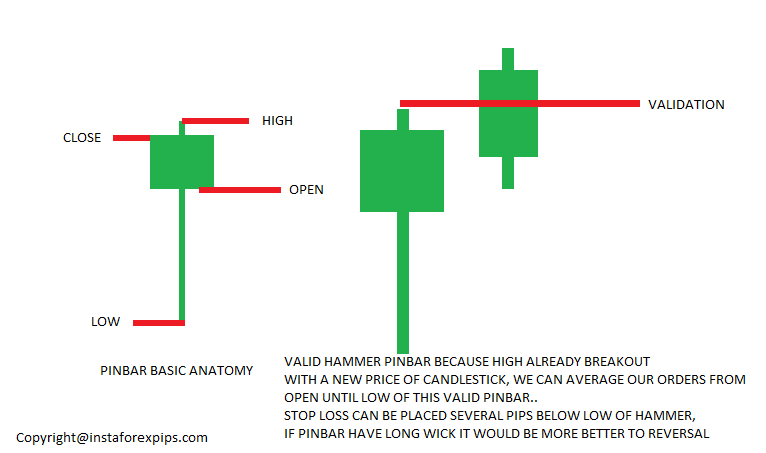

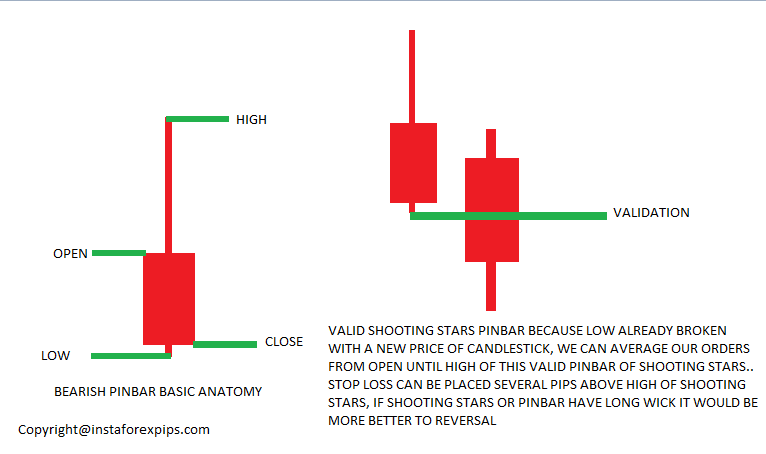

1. Valid Pin bars

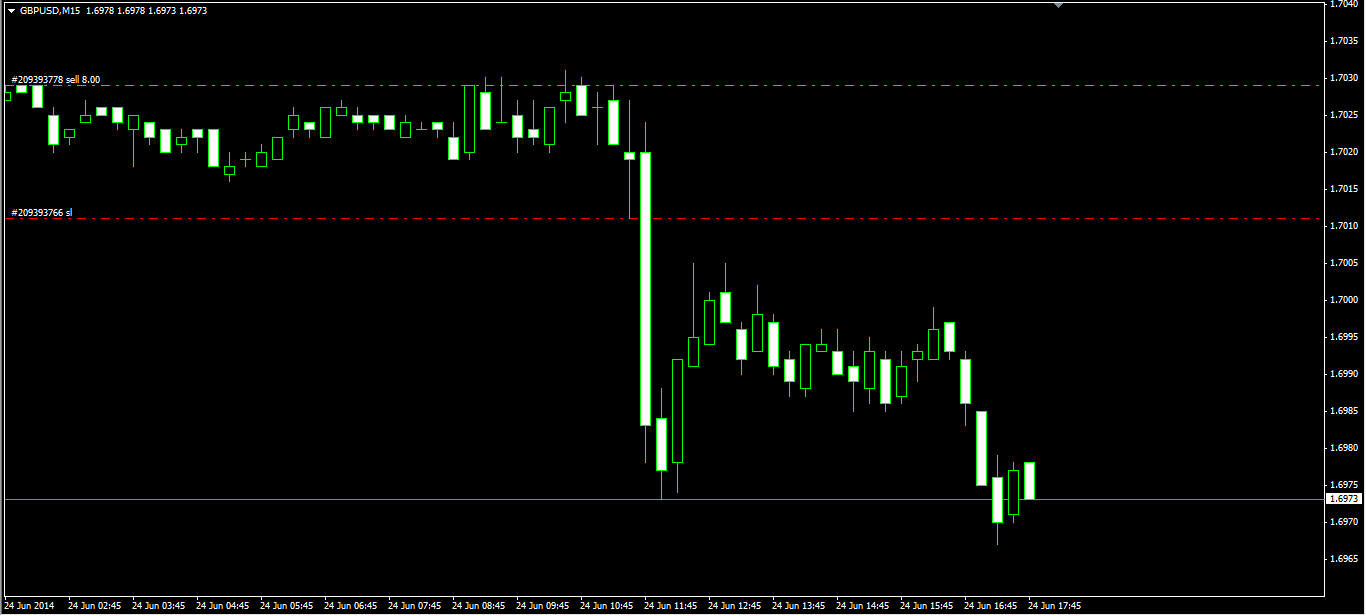

But which Pin bar? The answer is valid pin-bar. what is a valid pin bar? pin bar that is confirmed with a price break at high or low. Pin bars can be hammers, shooting stars, or doji with long wick. See the pictures below to see a valid pin bar and zone to average our open orders and place stop loss level of course.

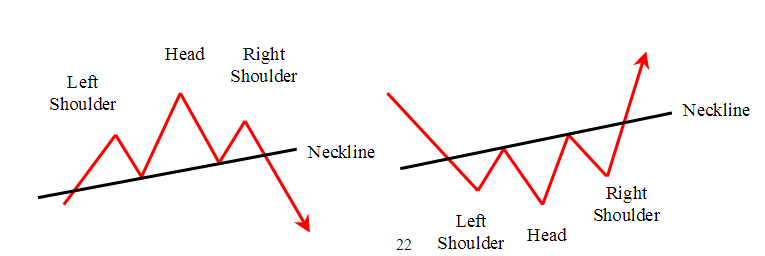

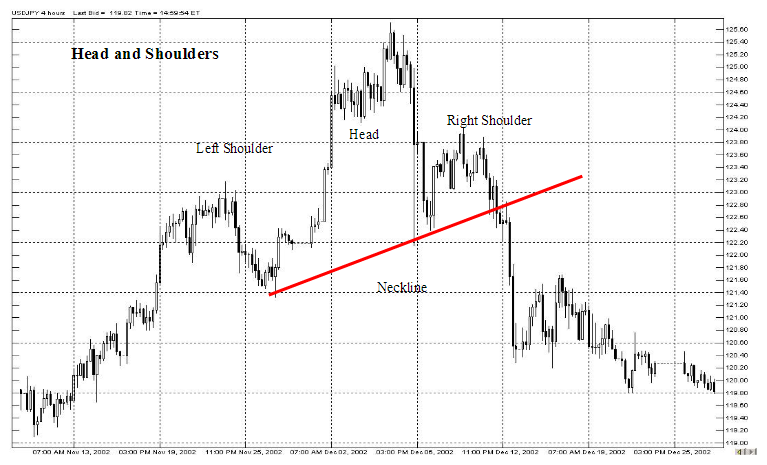

2. Forex Breakout Chart Patterns Strategy

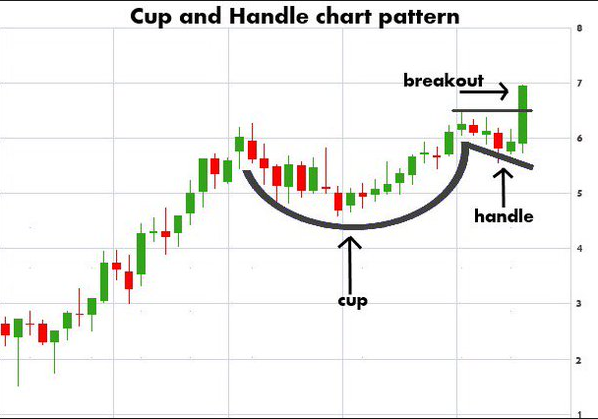

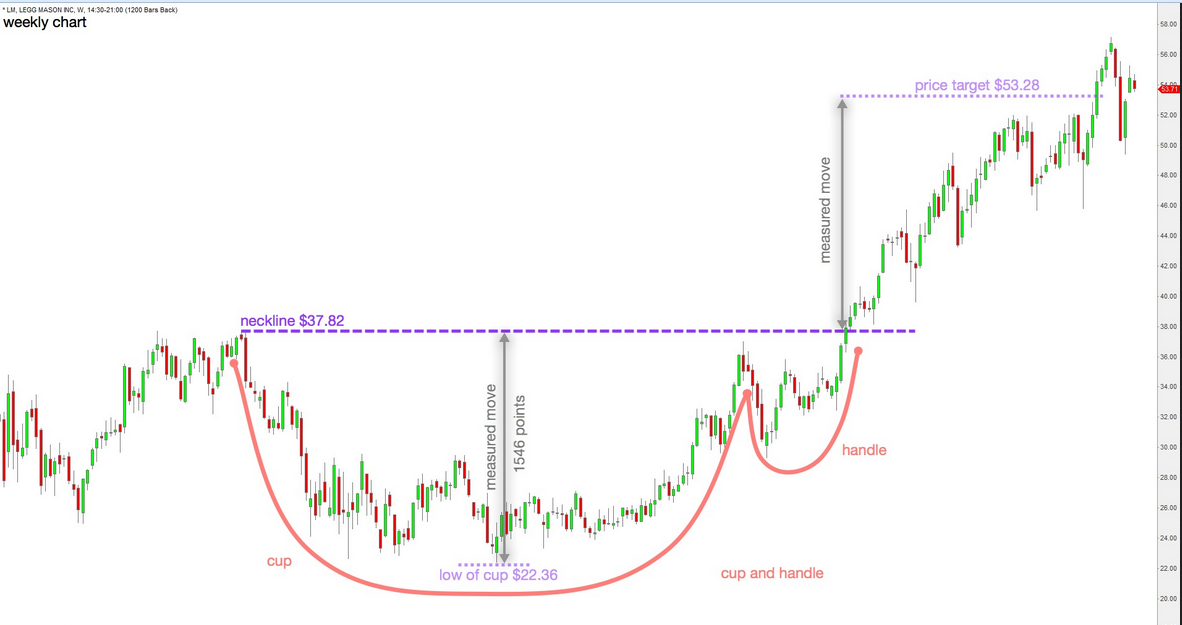

This method is very simple. Only using several most profitable forex chart patterns. The first is head and shoulder, the second is an ascending or descending wedge and the third are cup and handle chart pattern. All these 3 forex patterns must break first and close first based on confirmation level or neckline level then we wait for the pullback to the nearest confirmation level the averaging of open orders begins based on breakout direction of course.

Here are some pictures to learn forex averaging based on breakout forex chart patterns.

Head And Shoulder Forex Pattern Confirmation

Ascending And Descending Wedge Forex Pattern Confirmation

Cup And Handle Forex Pattern Confirmation

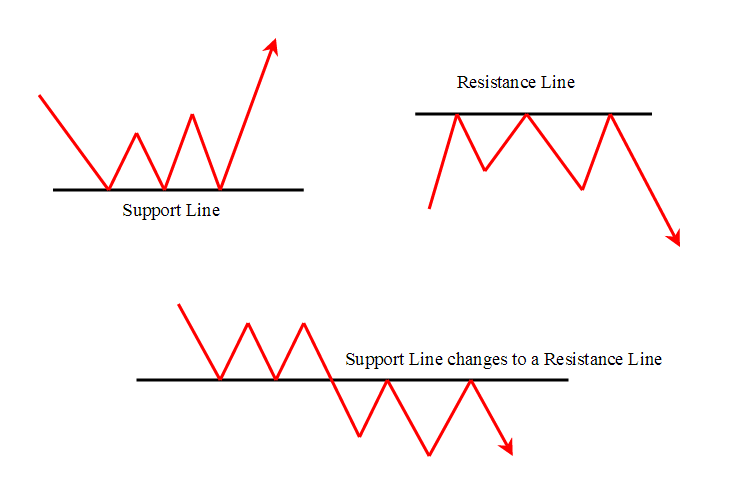

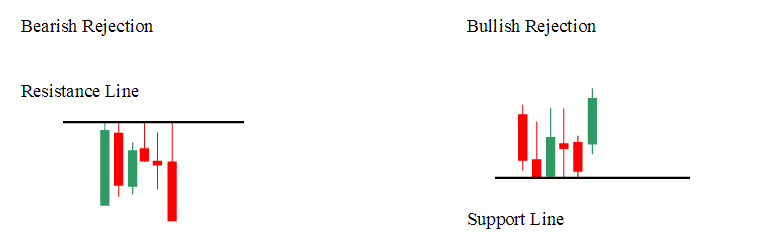

3. Support Resistance Zone As Our Reversal Area

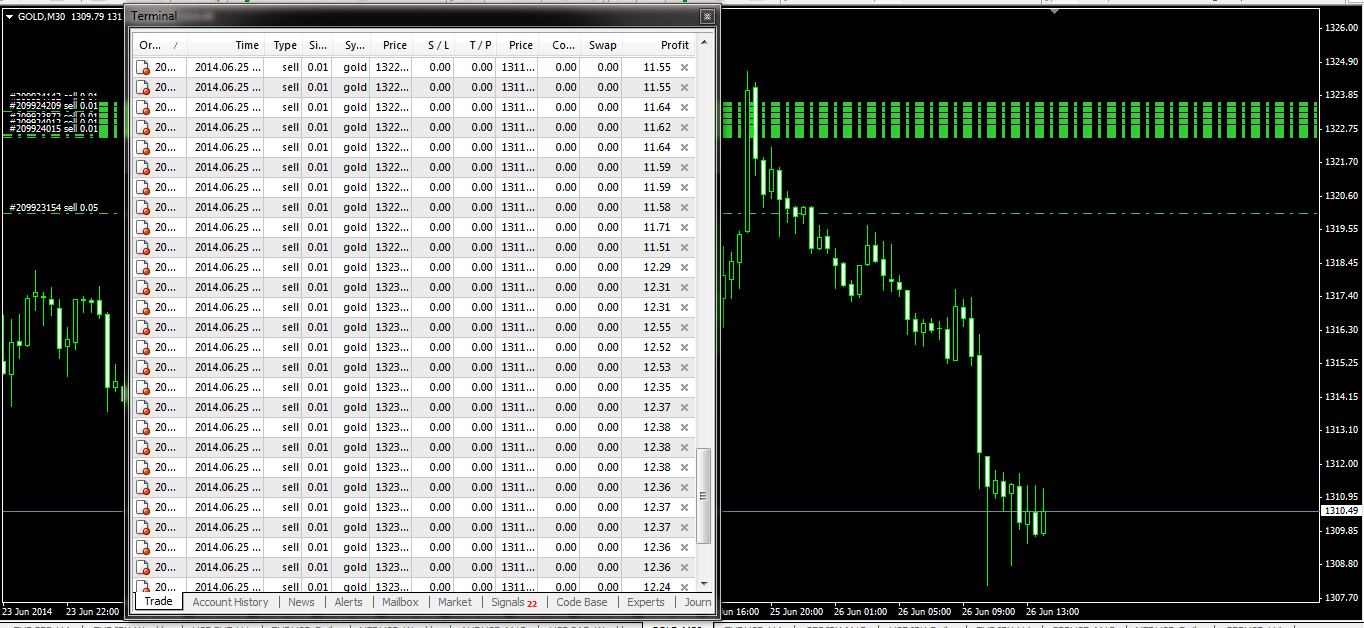

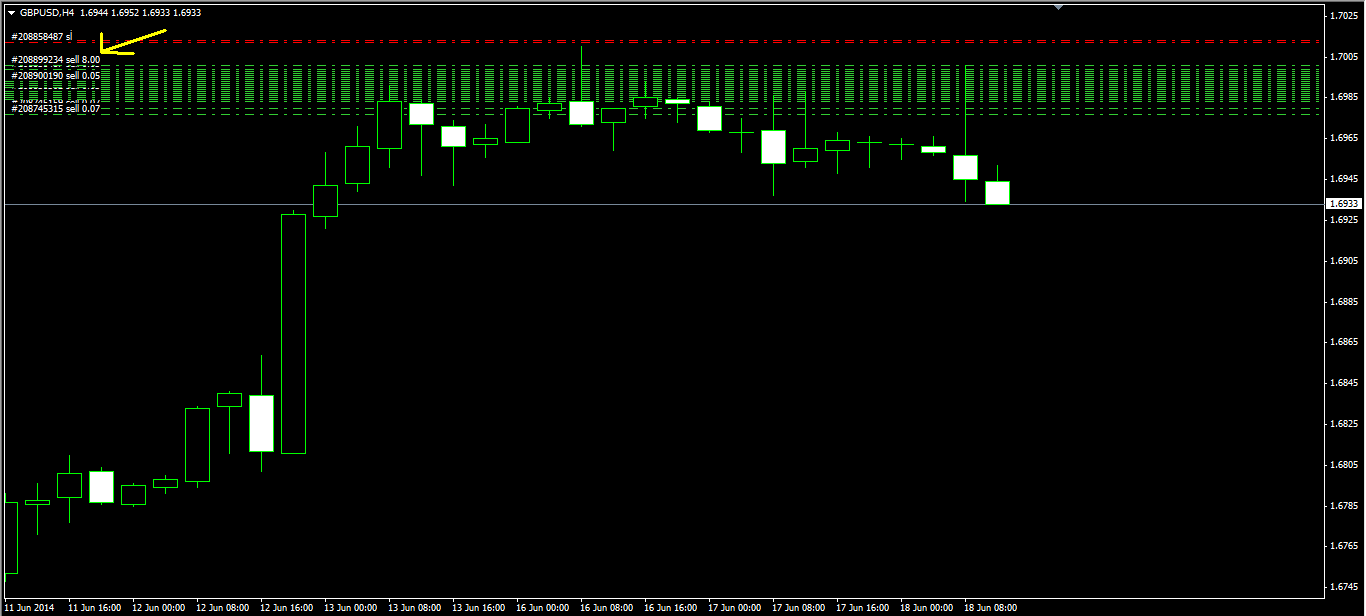

Averaging on support resistance zones only from four hours or daily or weekly time frame, because on at least 4-hour time frame support resistance zone stronger. You can use support resistance from daily to get more accuracy because support resistance from daily charts more stronger than 4h. Usually, I put my several open limit orders on this wick area that have been retested several times but failed. More longer the wick more stronger the support resistance level. See where we should put our averaging zone as the picture below.

Accurate Averaging Forex Trading Strategies Using Candlestick Reversal Patterns And Fibonacci Trading System

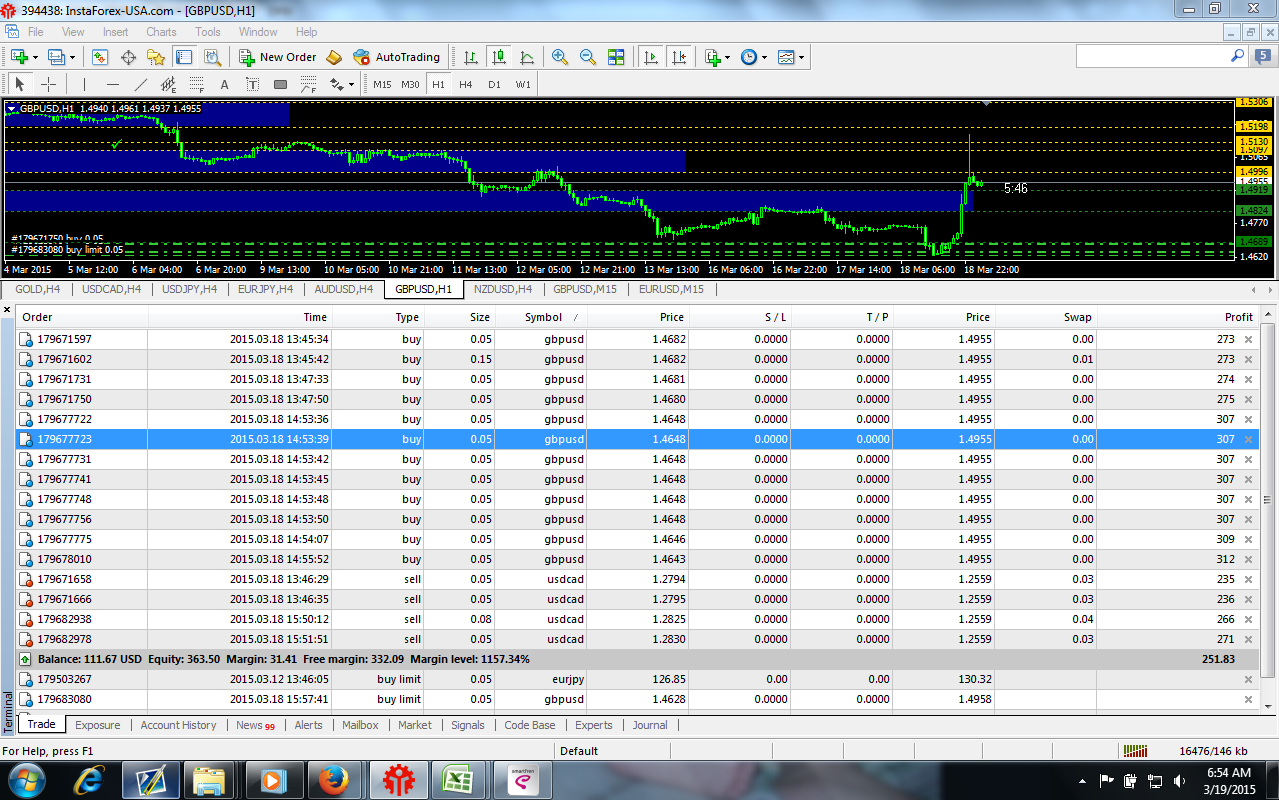

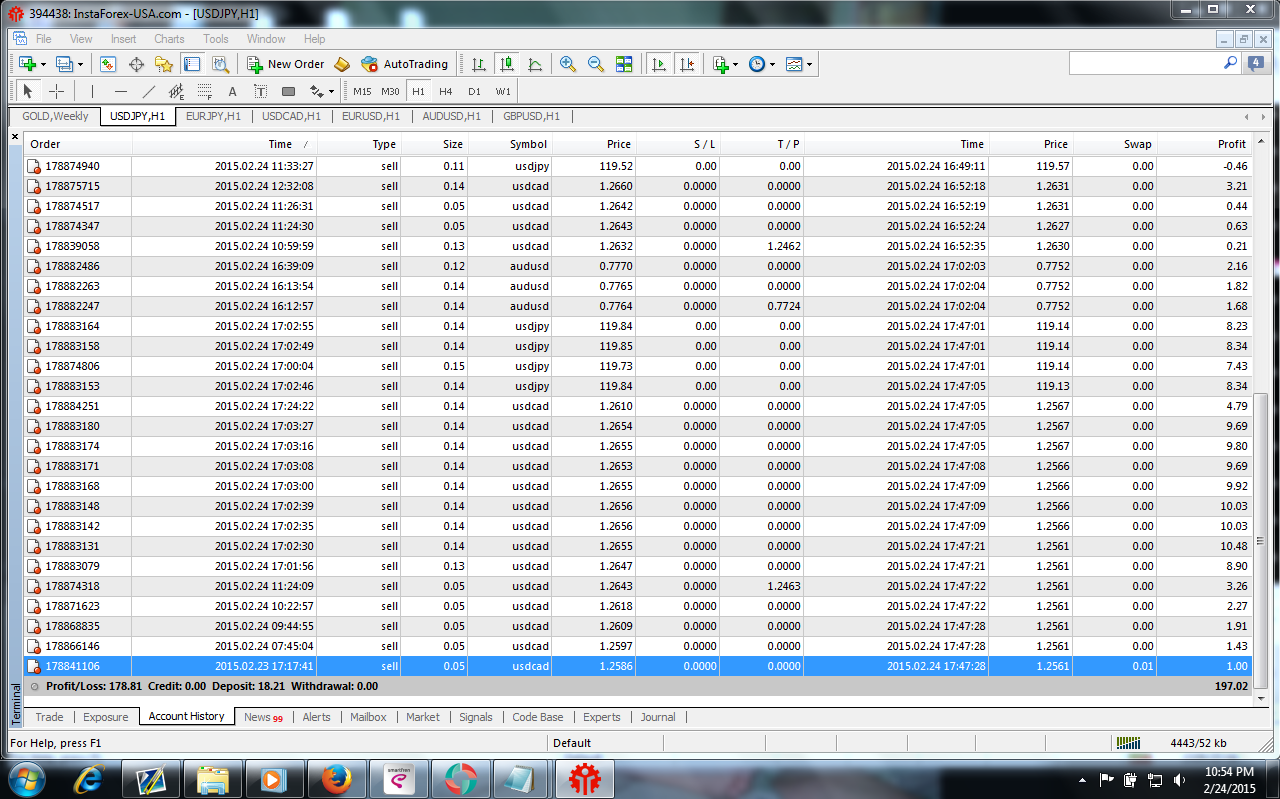

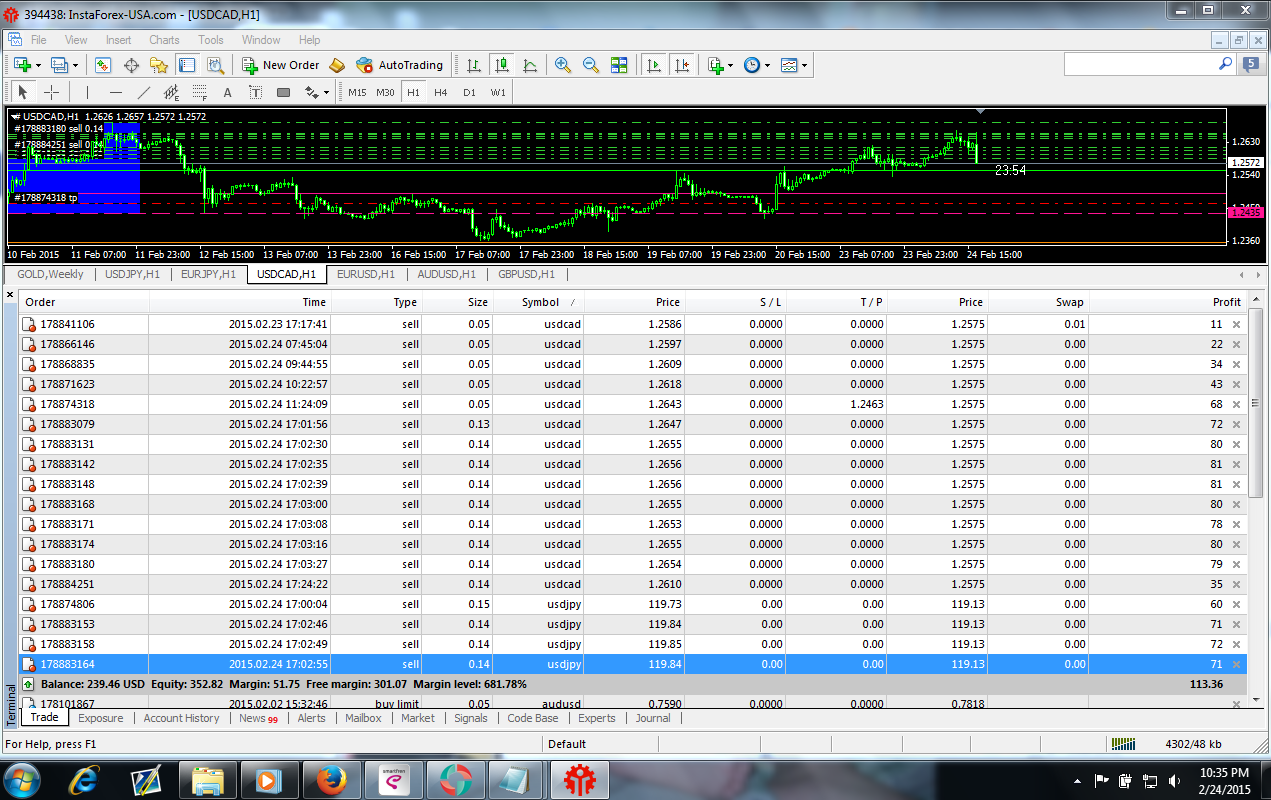

This accurate forex averaging strategy with “gold zones” as our true reversal levels zones which are called liquidity zones to measure entry levels can be learned, practiced, and applied by understanding this accurate trading strategy that works with almost 89% winning rate. Here is the step-by-step trading with liquidity trading method.

|

|

|

|

|

|

|

|

Happy practice using this averaging strategy.