Understanding Forex Trading: A Comprehensive Guide

Investments usually deal with 4 major pairs: Euro against US dollar, US dollar against Japanese yen, British pound against US dollar, and US dollar against Swiss franc or EUR/USD, USD/JPY, GBP/USD, and USD/CHF used to sign these pairs accordingly. These major pairs are considered as the Forex market’s “blue chips. Well known “buy low – sell high” gives the profit for currency trades.

Investments usually deal with 4 major pairs: Euro against US dollar, US dollar against Japanese yen, British pound against US dollar, and US dollar against Swiss franc or EUR/USD, USD/JPY, GBP/USD, and USD/CHF used to sign these pairs accordingly. These major pairs are considered as the Forex market’s “blue chips. Well known “buy low – sell high” gives the profit for currency trades.

What is Forex Trading?

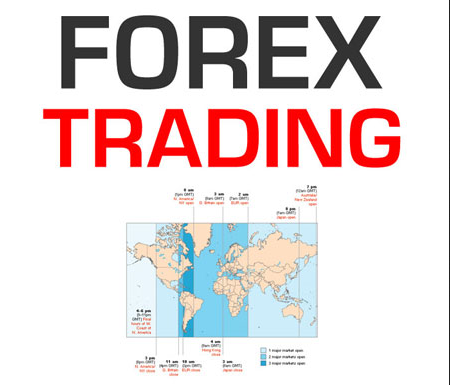

Forex trading involves the buying and selling of currencies in pairs, with the aim of profiting from the exchange rate movements. The most commonly traded currency pairs include EUR/USD, GBP/USD, and USD/JPY. Unlike the stock market, forex trading does not have a centralized exchange. Instead, it operates 24 hours a day, five days a week, across major financial centers globally.

The foreign exchange market is unique because of the following characteristics:

- Its huge trading volume representing the largest asset class in the world leading to high liquidity;

- Its geographical dispersion;

- Its continuous operation: 24 hours a day except weekends, i.e., trading from 20:15 GMT on Sunday until 22:00 GMT Friday;

- The variety of factors that affect exchange rates;

- The low margins of relative profit compared with other markets of fixed income; and

- The use of leverage to enhance profit and loss margins and with respect to account size.

There is no secret in forex market. Exchange rate fluctuations are usually caused by actual monetary flows as well as anticipations on global macroeconomic conditions. Significant news is released publicly so, at least in theory, everyone in the world receives the same news at the same time.

Unlike futures exchange and stocks, foreign exchange is indeed an interbank, over-the-counter (OTC) market which means there is no single universal exchange for specific currency pair. The foreign  exchange market operates 24 hours per day throughout the week between individuals with Forex brokers, brokers with banks, and banks with banks. If the European session is ended the Asian session or US session will start, so all world currencies can be continually in trade. Traders can react to news when it breaks, rather than waiting for the market to open, as is the case with most other markets.

exchange market operates 24 hours per day throughout the week between individuals with Forex brokers, brokers with banks, and banks with banks. If the European session is ended the Asian session or US session will start, so all world currencies can be continually in trade. Traders can react to news when it breaks, rather than waiting for the market to open, as is the case with most other markets.

Forex Market has 3 session in a day. First is Asia Session , Second is London Session and Last is USA Session. Forex has many parameter to learn. You need to know about LAVERAGE, lot management, swap, commission, pips, and many more. But the most important that you need to know is broker it self. You have to choose a good broker which have a good regulation it means registered their zone at least beside no commission and no swap and last no fee for deposit or withdrawal. In the next article, we can learn about for LAVERAGE, parameters from good forex broker, lot management, and forex account type .

Why Trade Forex?

There are several reasons why individuals choose to trade forex:

- Liquidity: The forex market’s immense size ensures that traders can enter and exit the market at any time, even for large transactions, with minimal price movement.

- Accessibility: The advancement of online trading platforms has made forex trading accessible to individual traders, allowing them to participate with a relatively small initial investment.

- Profit Potential: Forex trading offers the potential for significant profits due to the market’s volatility and the ability to use leverage to amplify gains.

- Diversification: Trading forex can be a way to diversify an investment portfolio, as it is not always correlated with other asset classes.

How Does Forex Trading Work?

Forex trading involves speculating on the price movements of currency pairs. When a trader believes that the base currency will strengthen against the quote currency, they buy the pair (known as going long). Conversely, if they anticipate the base currency will weaken, they sell the pair (known as going short). Profits are realized if the market moves in the anticipated direction, while losses occur if the market moves against the trade.

How to Trade Currencies

Trading currencies requires a good understanding of the market and the development of a sound trading strategy. Here are some essential tips for trading currencies:

- Know the Markets: Understand the factors that influence currency movements, such as economic indicators, geopolitical events, and market sentiment.

- Make a Trading Plan: Develop a clear plan that outlines your trading goals, risk tolerance, and the strategies you will use to trade the forex market.

- Practice: Before risking real capital, use a demo account to practice trading and refine your skills without incurring any financial risk.

- Choose the Right Broker: Select a reputable forex broker that offers a user-friendly trading platform, competitive pricing, and a range of educational resources. You can choose any good and regulated forex broker from right side bar.

- Manage Risk: Use risk management tools such as stop-loss orders to limit potential losses and adhere to sound money management principles.

The benefits of trading forex are numerous, making it an attractive option for many investors. Some of the key advantages of forex trading include:

- Accessibility: Forex trading is relatively easy to enter compared to other markets, making it an attractive option for beginners and retail traders. The advancement of online trading platforms has further enhanced its accessibility.

- Liquidity: The forex market is the largest financial market globally, with over $4 trillion USD exchanged on average per day. This high liquidity means that traders can enter and exit the market with minimal price movement, even for large transactions.

- Convenient Market Hours: The forex market operates 24 hours a day, five days a week, across major financial centers globally. This provides traders with the flexibility to trade at any time, making it convenient for those with other commitments.

- Ability to Trade on Margin: Forex trading allows traders to trade on margin, meaning they can control a large position with a relatively small amount of capital. This offers the potential for significant profits, but it’s important to note that it also increases the risk of losses.

- No Commissions: Most retail forex brokers are compensated for their services through the “spread,” meaning there are no commissions, clearing fees, exchange fees, government fees, or brokerage fees.

- Diverse Markets: In addition to trading currency pairs, forex traders can also access other markets such as commodities, indices, and cryptocurrencies, providing a diverse range of trading opportunities.

- Low Costs: Forex trading can have very low costs, with no separate brokerage charges and minimal overhead costs. This makes it an attractive option for traders looking to minimize expenses.

- Being Your Own Boss: Forex trading offers the opportunity to be your own boss and make money using a laptop or mobile device, providing flexibility and autonomy in trading activities.

While forex trading offers numerous benefits, it’s important to be aware of the potential drawbacks, such as high risk, volatility, and the need for a robust trading plan. Traders should carefully consider these factors and ensure they have the necessary knowledge and risk management strategies in place before engaging in forex trading

In conclusion, forex trading offers a range of opportunities for traders to potentially profit from the dynamic movements in currency markets. By understanding the fundamentals of forex trading and implementing effective risk management strategies, individuals can participate in this exciting and potentially rewarding market. By incorporating the insights and tips provided in this article, traders can enhance their understanding of forex trading and make more informed trading decisions. Whether you are a novice or experienced trader, the forex market offers a diverse and dynamic environment for pursuing trading opportunities.