Hey Forex Traders, I just wanted to point out some nice trades that had formed recently on the EURUSD and GBPUSD. Below are some charts with classic examples of some of my price action ...

[Continue reading]Month: March 2013

Pin Bar Candlestick Forex Trading Strategy

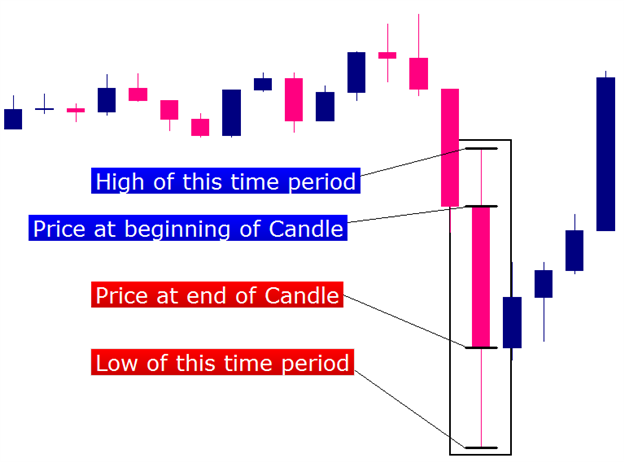

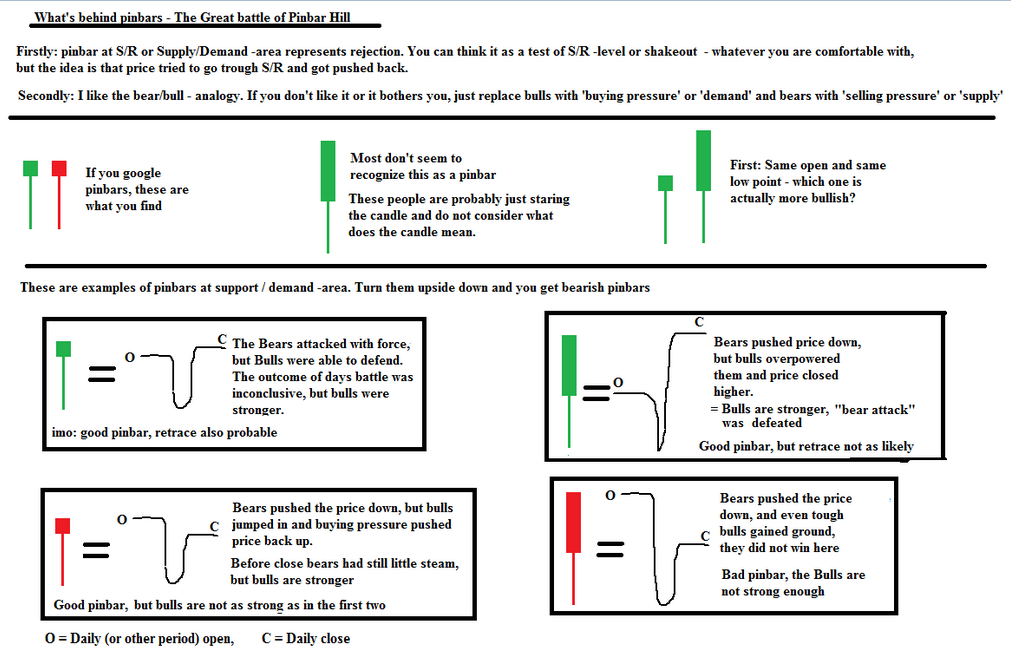

An Explanation To The Pin Bar Forex Trading Strategy and How to Trade It Effectively The pin bar formation is actually a price reversal pattern consisting of three bars. Once familiarized with pin bar ...

[Continue reading]Price Action Chart Patterns: Pin Bars, False Breakout, Inside Bars

Trading forex sometimes is complicated enough. But by identifying true or false price action breakout patterns we can know what exactly the market will go. And for sure economic news is still in play ...

[Continue reading]Introduction To Price Action Forex Trading Analysis

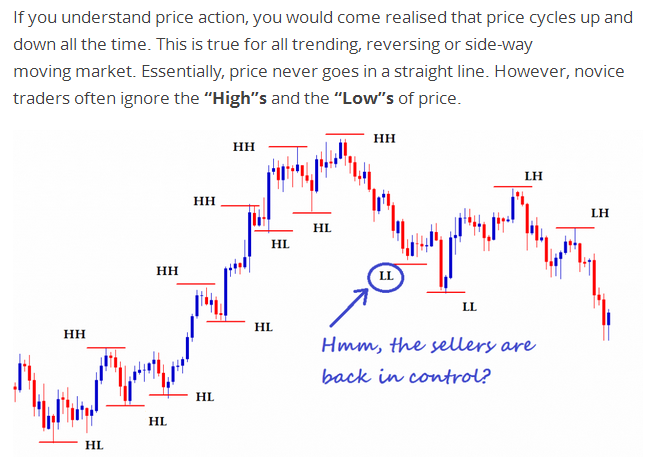

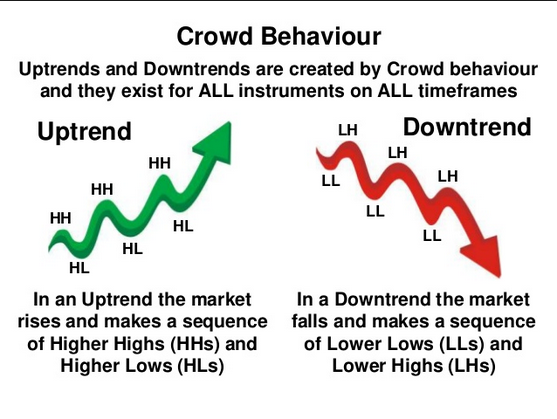

Today we’ll learn about what exact definition of price action forex trading analysis. Using price action forex trading analysis is almost called “how to read market movement only from clean charts forex“. You can ...

[Continue reading]Price Action Strategy To Get Steady Profit From Forex

Price Action Forex Trading Strategy Today’s education will focus on some price action trading rules. The most important thing in any type of trading is to have a solid set of rules and then ...

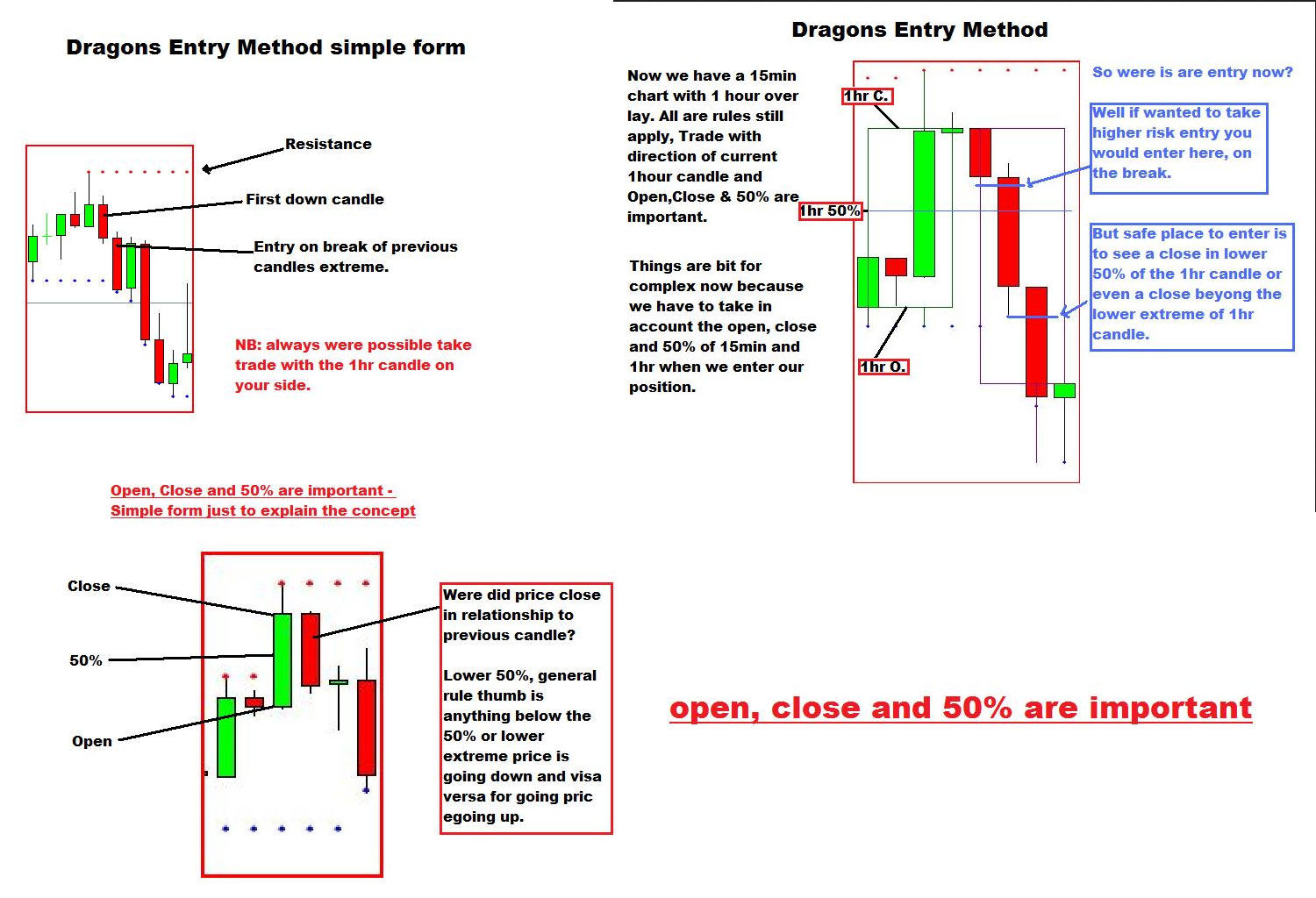

[Continue reading]Dragon Trading Method

Intraday Scalping Forex Trading Strategy Another scalping method is dragon trading method. Sometime in our head give a question about how much money can you make with scalping strategy? it’s normal right. So, from ...

[Continue reading]Averaging Forex Strategy On Sweet Spot Strong Reversal Area

Forex averaging strategy is a very good strategy if we can identify a strong reversal zone as our averaging area and use tight money management. Why? is because several open positions places with some ...

[Continue reading]Moving Average Convergence Divergence

As we know moving average convergence divergence is easiest way to analyze forex market with fast and simple. The Moving Average Convergence-Divergence (MACD) indicator is one of the simplest and most effective momentum indicators ...

[Continue reading]Trend Lines Breakout System

Forex trendline breakout trading strategies like this are always in great demand. It is quick, easy, and with proper use has a true winning rate of over 80%. Pair: GBP/USD, EUR/USD – tested. Other ...

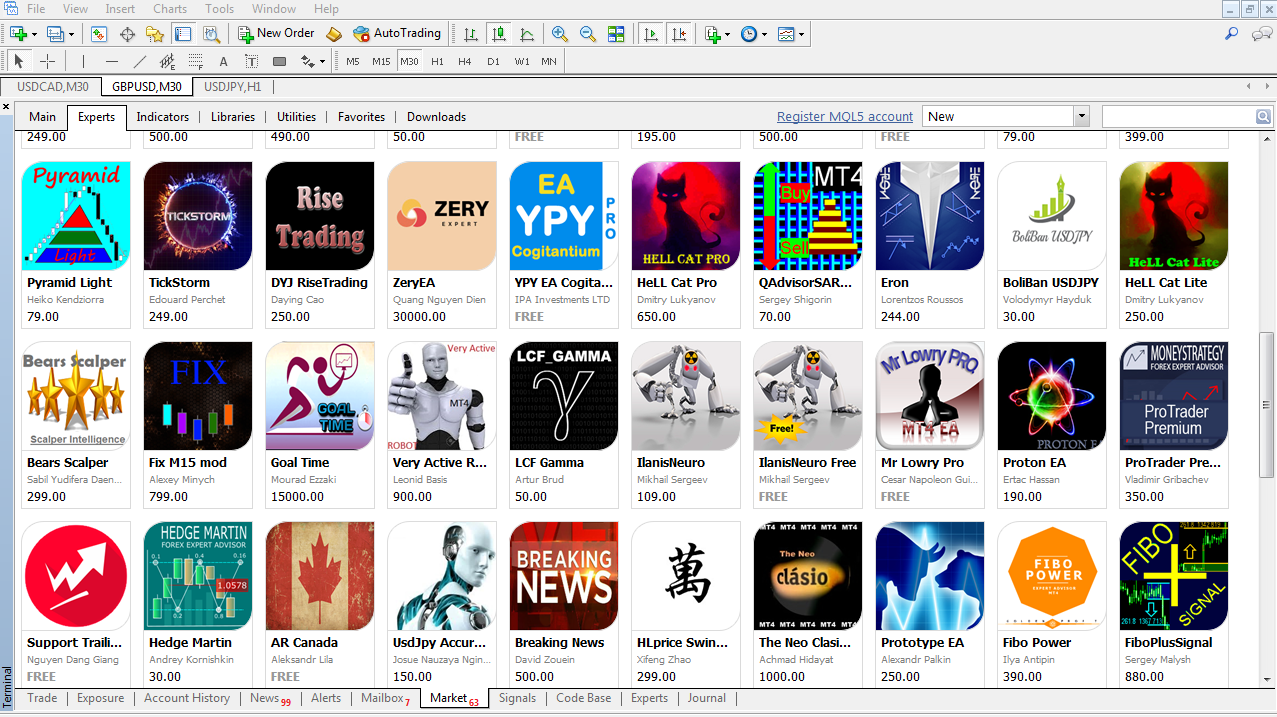

[Continue reading]Sometimes Expert Advisor Is Very Help Full To Get Fastest Way On Entry And Exit Level

Thinking about using automated forex trading software ? yes the answer is forex expert advisor, that’s have smiley face on right corner on metatrader 4.0 platform. Yes, its true expert advisor sometimes is very ...

[Continue reading]GBPUSD And EURUSD Simple Scalping Trading Forex

Once again, gbpusd and eurusd is major pairs that we like using scalping on these two kind of pairs. This method only uses macd, stochastic, and ema. Here is more detail below, so keep ...

[Continue reading]Scalping 5 Pips On GBPUSD

GBPUSD is most favorite pair on trading forex. Because little bit complicated and volatile on GBPUSD, most forex traders like using these pairs with martingale, averaging and all of most traders use this pair ...

[Continue reading]Scalping With Trend Lines

Very Easy Simplest Scalping Forex With Trendline Trend lines are great tools to identify the forex market trending or sideways. Even trend lines have no lag indicator. No repaint indeed. Actual price market-based open ...

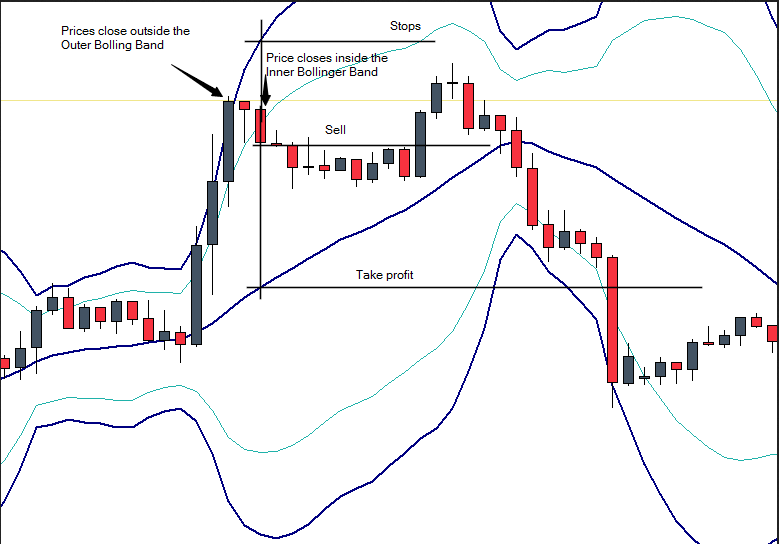

[Continue reading]Scalping Using Bollinger Bands

Scalping is most favorite techniques almost for all forex trader in the world. Why ? The answer is easy. Scalping is very fast to get money in forex. Forex scalping has gained high popularity ...

[Continue reading]